We use cookies to personalise and enhance your experience.

It’s a stereotypical film scene. The young rising star goes out for a night on the town with the office bigshot. Punchy one-liners about life’s pressing issues are exchanged. The drinks are flowing, and if the writers are going full-cliché, there’ll be some flirting with a bartender at some point in the evening.

Once things start winding down, the exec will pull out a shiny Amex and say “Put it on the company account.”

While it’s true that food and beverages can sometimes be written off as business expenses, this is down to individual company policy. And even though, as a self-employed person, you ARE the company, the final call on this isn’t yours to make.

That decision rests with none other than Her Majesties’ Revenue and Customs.

The good news is that the approved list of expenses you can deduct from your total income is pretty comprehensive. And while your daily coffee run is unlikely to make the cut, you might be pleasantly surprised by what you CAN deduct.

Let’s take a closer look at HMRC’s approved list of self-employed business expenses.

Office expenses

Whether you’ve decided to rent an office, or are working from home, you’ll be investing in your space. This particular category consists of items you would normally use for less than two years.

HMRC’s list for this is as follows:

- phone, mobile, fax and internet bills

- postage

- stationery

- printing

- printer ink and cartridges

- computer software your business uses for less than two years

- computer software if your business makes regular payments to renew the licence (even if you use it for more than two years)

You’ll notice that larger hardware (like that new laptop you might have your eye on) isn’t listed here. The good news is that you can claim towards office equipment such as printers and computers. These can be partially or fully deducted from your pre-tax revenue two different ways, depending on the system you choose (cash basis vs traditional)!

Business premises

As more of us shift to working from home (and bulk-buying leisure wear), it's inevitable that those extra hours spent plugging away will impact our utility bills.

Unfortunately, the following list from HMRC only applies in full to registered business premises:

- rent

- maintenance and repair

- utility bills

- property insurance

- security

While rent and maintenance is included here, this tragically doesn’t extend to mortgages or building costs for those of us lucky enough to own/construct the workspace of our dreams…

Yet. Here’s hoping.

On a happier note, if you run your business from home, you can claim part of your utility bills towards expenses. Before you rush to hike that thermostat (or take out that amazing new fibre Wi-Fi deal with the Sports package included), remember we said ‘part’. And that part needs to be methodically calculated according to how much of that utility is actually used for business.

If the notion of somehow applying long division to individual wattage bulbs makes your toes curl - don’t panic! You can find examples of how to break this down on gov.uk’s website (we can also help guide you through it, just get in touch).

TOP TIP: If you work from home at least 25 hours a month, consider using ‘simplified expenses’.

Travel

Whether it's dropping off that gorgeous handmade product to a delighted client, or driving out to meet a potential supplier, every small business owner needs to travel at some point.

HMRC allows you to claim business-related car or van costs on your tax return, including:

- vehicle insurance

- fuel

- hire charges

- repairs

- servicing

- breakdown cover

You can also claim for travel expenses for any of the following (as long as it’s specifically for business):

- Train

- Bus

- Plane

- Taxi

- Hotel Rooms

- Meals

While we’d all love a guilt-free stay at The Dorchester, just make sure you can back up any overnight business trip expenses if push came to shove. Also, travelling between work and home sadly doesn’t count towards expenses (great excuse to splurge on that e-bike...it's clearly an investment)!

Also, if you’re traveling for a mix of ‘business and pleasure’ as the old saying goes, you can still claim the business expenses back - as long as you can separate them from personal expenses.

Another common misconception is that money spent on entertaining clients, suppliers and customers, or event hospitality can be claimed back. After all, the power of wining and dining can never be underestimated when it comes to closing a deal. Unfortunately, HMRC aren’t interested in splitting this particular bill just yet (though there’s always hope for the future)!

One final point on the travel expenses list is purchasing a vehicle. If you buy one specifically for your business, and you use traditional accounting, you can claim it as a capital allowance.

Even if you use cash basis accounting, you can still claim the car as a capital allowance (as long as you’re not using simplified expenses).

TOP TIP: If you’re not sure whether to use cash basis or traditional accounting, we can help you make the best decision for your business!

Stock and materials

Any stock, raw materials or direct costs that are a result of producing your product can all be claimed. However, any materials that you’ve bought for personal use isn’t allowable. You also can’t claim for depreciation of equipment (so stay on top of that maintenance!).

Legal and financial costs

As your business grows, the need to bring in the proverbial ‘big guns’ will crop up at some point. By ‘big guns’, we’re talking solicitors, surveyors, architects, and accountants. While paying for quality services like these can be pricey, here’s the good news: if you need to hire a professional for business purposes, you can add this to your expenses!

On the financial side, HMRC also allows you to include bank, overdraft and credit card charges, interest on bank and business loans, hire purchase interest and leasing payments.

If you’re using traditional accounting, you can claim for what’s known as ‘bad debt’. This is money that was owed you, but that you haven’t received and don’t expect to receive. Cash basis accounting users aren’t able to use this, though. This is because with cash basis accounting, you only record income you’ve actually received on your tax return.

In case you’re wondering what counts as ‘bad debt’ (is there such a thing as good debt?) here’s a list of what doesn’t:

- debts not included in turnover

- debts related to the disposal of fixed assets, for example land, buildings, machinery

- bad debts that aren’t properly calculated – you can’t just estimate that your debts are equal to five percent of your turnover

- fines for breaking the law as business expenses, or for repayments of loans, overdrafts and finance arrangements.

TOP TIP: If you’ve decided to use cash basis accounting, you can still claim up to £500 in interest and bank charges.

Business insurance

It’s probably happened to all of us at some point. That new iPhone that you’ve only had a week slips out of your hand and screen-plants on the pavement. After the initial panic wears off, a comforting thought soothes the heartbreak: “At least I have insurance!”

When it comes to your business, insurance is perhaps one of the most vital expenditures you can make. True, it isn’t cheap - but the amount it will save you should things go pear-shaped far outweighs the costs.

Self-employed business owners can add business insurance to their expenses claim. This typically includes:

- public liability insurance

- professional indemnity insurance

- employers’ liability insurance

Marketing

You know exactly what you have to offer. You have an amazing product and you’re willing to go the extra mile to deliver results for your clients. But getting that point across in the right way, to the right target audience, via the right channels can feel overwhelming. Figuring out how to market your brand is challenging enough without stressing about how much it's going to cost you.

Fortunately, you can claim marketing costs on your business expenses. This includes:

- Newspaper advertising

- Directory listings

- Mailshots

- Free samples

- Website costs

It’s all deductible from your profits - so go ahead and launch that amazing ad campaign you’ve been dreaming about!

Clothing

If, like us, you were secretly hoping this was a green light to update your power-dressing wardrobe, that’s sadly not the case. By ‘clothing’, HMRC is referring to:

- Uniform

- Necessary protective clothing

- Costumes for actors or entertainers

All of this can be claimed on your expenses. Everyday work outfits - even that 5-pack of button-down shirts - sadly fail to make the cut (pun intended)!

Staff costs

Whether you’re a sole trader or you employ some help, any official salaries you pay can be deducted from your final profits. This includes:

- bonuses

- pension contributions

- benefits

- agency fees

- employer National Insurance contributions

- training courses related to your business

TOP TIP: Always pay yourself a wage and keep it separate to the rest of your income. That way, you’ll have a better idea how much money your business has to work with - which in turn will help you budget accordingly.

Not clear on how much to pay yourself? Get in touch - we’ll help you put yourself first for a change - without scuppering your business!

Subscriptions

No, not Netflix. Not Prime either. Definitely not Disney Plus (HMRC is cruelly immune to the charms of Baby Yoda).

The subscriptions in question are a lot less exciting (but arguably better for your business). For example:

- membership to trade bodies

- professional membership organisations if they’re relevant to your business)

- subscriptions to trade or professional journals.

TOP TIP: Becoming a member of a recognized trade body in your industry will boost your credibility. It usually also comes with benefits and perks - plus the digital badges will score you major authority points with Google!

While the above list is pretty comprehensive, it isn’t all-encompassing. If you’re tallying up expenses and find you need more clarity, why not hop on a free call with Addition? We can chat about your business and let you know what you can claim for. You might be pleasantly surprised!

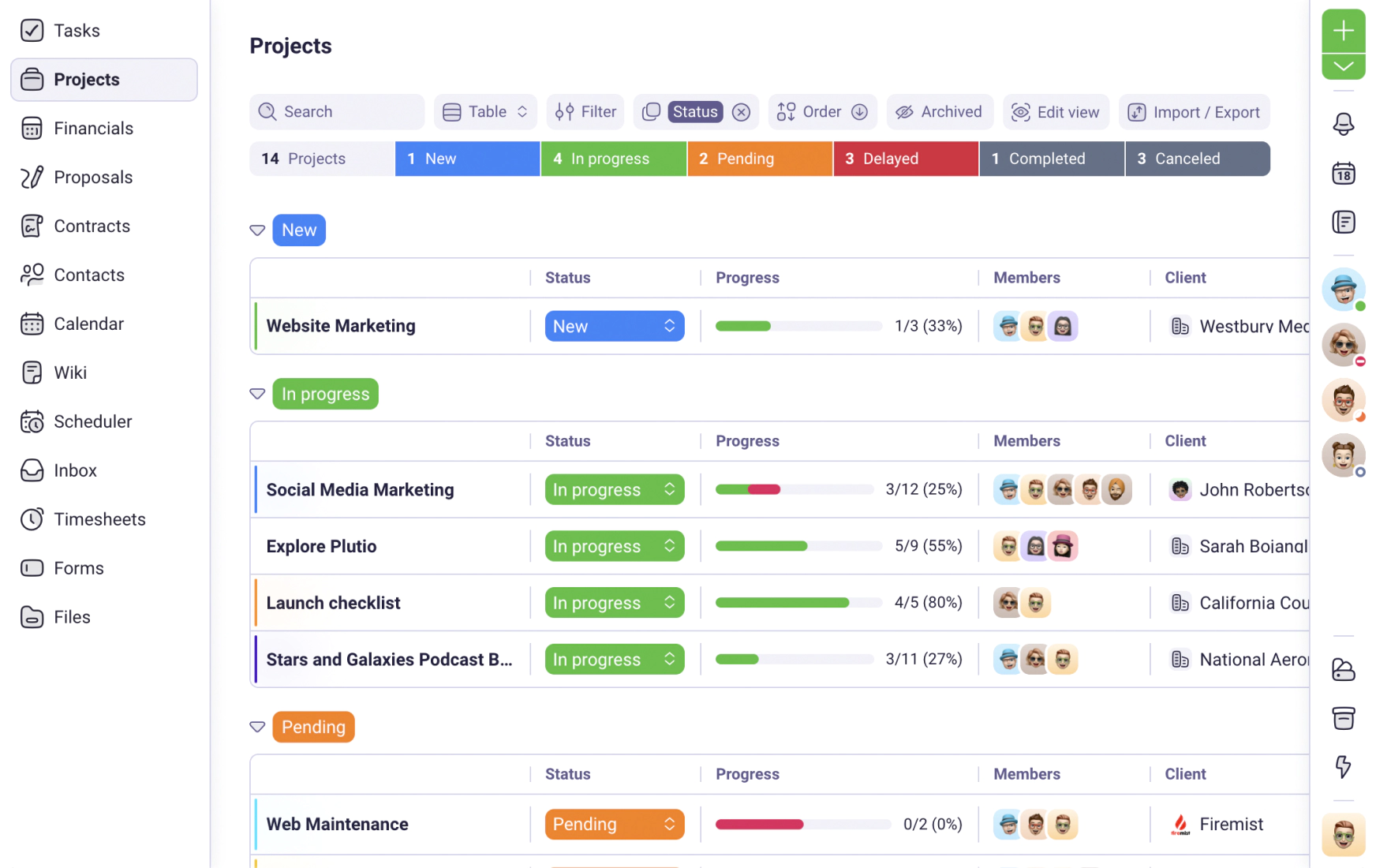

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required