We use cookies to personalise and enhance your experience.

Most people know how tiring it could be to think about taxes. While most employees in companies have this part of the job covered, freelancers have to file their taxes by themselves. Freelancing has its own freedoms, but this type of work still requires filing taxes. It doesn’t matter where you work in the US, how many hours you spend on your projects, or who your clients are. Taxes are a necessary part of every freelancer’s job. Further in this article, take a look at the basic facts you must know about freelancer’s taxes.

Things you should know about paying taxes

Paying taxes is not always easy to do, especially without having a steady income. However, full-time freelancers often have the chance to earn good salaries and get their paychecks monthly. When it comes to freelancer’s taxes, people who work for themselves have similar obligations as other employees in bigger companies. If you are a freelancer, being your own boss will have its upsides. However, paying taxes will also be one of your responsibilities.

There are different types of tax regulations. Most commonly, the amount you have to pay will depend on the size of your income. Whether you work as a full-time or a part-time freelancer, you will have to fill out your taxes. So, how much are these taxes going to cost? Will you be able to calculate your tax expenses in advance? Which form will you have to get? These, and many other questions are very common for freelancers. Since the nature of their job is different from one project to another, it’s no wonder paying taxes can be so confusing.

Basically, what you’ll need to do is to calculate how much you earn annually. In case you earn at least $400 for your work, paying taxes will be a necessity. This amount of money will require paying an additional self-employment tax, which will be 15.3%. Also, you will need to pay your regular income tax. This is one of the obligations that companies usually cover for their employees. The amount of money you’ll give on these taxes will depend on how much money you make. In other words, as a freelancer, you’ll have to pay your taxes as an employer and an employee at the same time.

How to plan freelancer’s taxes in advance?

Avoiding freelancer’s taxes is never a good idea. On one hand, you could get in trouble with the IRS. On the other, piling up your tax costs will also be a problem, especially if you earn bigger amounts of money. As a freelancer, you will have to file your taxes on the same day as the rest of the taxpayers. In the US, this date is always in April, so you should calculate your costs in advance.

Since you will be both your own boss and an employee, the IRS's recommendation is to pay your taxes quarterly. Having in mind that your monthly income could vary, this is often an easier solution for most freelancers. If you don’t have a steady income, the best thing you can do is to set some money aside every month. There is no fixed amount of money you’ll need, but it’s recommended to set aside at least 25% of your monthly income.

Tax procedures for freelancers in the US

When it comes to freelancer’s taxes, there is a universal form you should find and fill out. This form is called the 1099-MISC form. If you are paid more than $400 during one tax year, there is an easy way to get this form. All you need to do is to ask a client who paid you. Since their company will have proof of transferring the money to your account, they should provide you with this form.

Self-employment could sound like a complicated thing, especially when it comes to paperwork. Besides paying regular income taxes, you will have to check if you’ll need to learn about Form 1040. If you are not running your own business, you will not have to get it.

Another thing you should get familiar with is the process of claiming tax deductions. Plenty of freelancers don’t do this since it’s only another one of their costs. However, if you spend more than your intellect to get the work done, you can claim tax deductions. This procedure will help you save money since it will show that you technically earn less. If you work with any inventory or you need to buy tools for maintaining your work, make sure to keep track of it. Also, have in mind that the IRS has strict rules about claiming tax deductions, which is why you should get familiar with all the regulations on time.

What tax forms will you need as a freelancer?

As we mentioned before, a 1099 form will be needed for filling freelancer’s taxes. This form is there to report income that is not gained through employment. The 1099 form comes in various types. Being a freelancer is a broad term, which is why you should get proper information before calculating your tax expenses. There is a vast number of freelancers in the US that earn different amounts of money. No matter the size of your income, paying freelancer’s taxes will be necessary.

Summary

Even though being a freelancer has its upsides, their income is not one of them. Besides having an income that is not always steady (or nearly enough), paying taxes is an unavoidable part of the job. Freelancer’s taxes don’t differ as much from the rest of taxpayers’. However, being a boss and an employee is never easy. If you are working as a freelancer in the US, get ready to set some money aside and pay your income taxes regularly. By doing so, you will avoid piling your expenses, but more importantly, avoid troubles with the IRS. Make sure to get all important information on time and pay attention to any news regarding freelancer’s taxes.

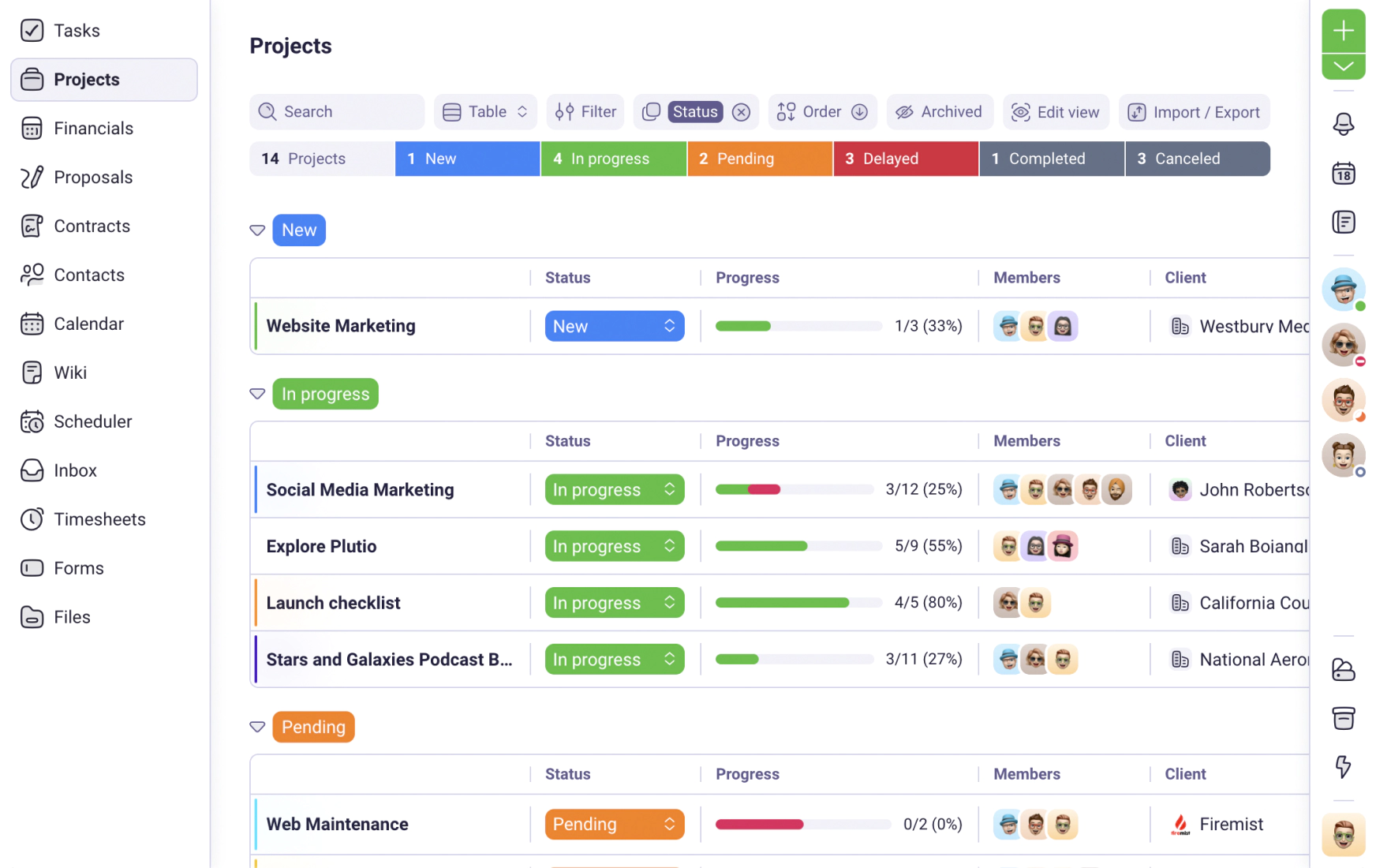

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required