We use cookies to personalise and enhance your experience.

5 Tips for Avoiding Card Fraud and Scams

March 25, 2022

If you've ever traveled to another country you know that no matter where you are, there are certain universal human truths. People are generally kind and helpful, we all love to eat, and we all want to know that our money is looked after safely.

However, with the rise of online banking and shopping, the risks to our money are more significant than ever.

Luckily, there are precautions you can take to ensure your finances are secure. From keeping an eye on your bank statements to shopping with reputable companies, you can rest assured that your money is kept safe if you follow these guidelines.

1. Regularly Check Your Statements

It is vital that you pay regular attention to your bank statements and monitor all the comings and goings of your money to ensure everything lines up correctly with your transactions. Almost 200 million dollars was lost in 2021 to scams so keep an eye on your money to reduce the risks and increase your wariness.

Make a weekly or monthly habit of running through your accounts regularly to stay on top of your money’s safety.

To further secure your account, most banks offer alert services when something fishy or unusual occurs. Ensure you make use of these assists to help you catch suspicious activity.

2. Avoiding Scams Related to Online Banking

In 2021, 151,000 scams have so far been reported. Whilst your bank does everything it can to protect your money, you must remain vigilant. Online banking can be incredibly efficient, but it poses its own dangers.

Be wary when being contacted about your bank accounts. Your bank will not ever request account details by text or email. If you receive a suspicious text or email asking for bank details and threatening to close your account should you not provide the information, do not respond and report the scam to your bank.

Scams can similarly pose as other supposedly trustworthy institutions besides your bank, such as faking emails from the government. Make sure you never give out your bank details unless you are sure you are dealing with a reliable business. If unsure, you can always go into the branch or store to sort out your finances.

You might also consider splitting your money between several bank accounts so that you don’t lose all your money if one should be put at risk. It might require more effort to review your statements each month, but it is more secure in the long run if one of your accounts is compromised.

3. Pay Attention When Shopping Online

Online shopping similarly can be risky. Always make sure you are buying from a reputable and secure site. If you are unsure what to look for, ensure the web address begins ‘https://’ and has a padlock sign, in which case the website is safe to use. You can also look at reviews to ensure your peace of mind.

It is also a good idea to use Paypal or another secure system rather than giving your bank details directly as it keeps your financial information confidential. Although, be wary of what smartphone apps you let access your bank details as some third-party apps might be compromised.

4. Keep Documentation on Your Purchases

Finally, make an effort to keep documentation detailing any purchases, investments, or insurance statements. Receipts can help you trace suspicious-looking payments on your bank statements and support any claims you might want to make. Ensure you regularly compare your receipts with your bank statements.

It is also imperative to keep documents if you are going through a divorce or separation. Some relationships inevitably break down, and in such cases, it is good to have 12 months of supporting documents like bank statements or tax returns to make for an easier settlement.

Property settlements can be a challenging and sensitive process. Keeping a record of your most recent transactions and documents can ensure a smoother transition, as the last thing you will want during that time is to worry about your finances.

Entrusting your money to others can be worrisome. However, the right level of vigilance and taking care when paying can ensure that your money is well protected without the need for stress. Taking the time each week or month to run through your finances will go a long way to safeguarding your money and helping you sleep better at night.

5. Use a Virtual Debit Card Service

Often dubbed the password managers of debit cards, virtual card services allow you to create one-off cards for each online merchant you make a purchase from. Because these cards limit the total amount of monthly debits or number of transactions, they reduce your financial liability should a card number be compromised. It also means you don't have to use your real debit card information, which again, decreases the risk of shopping online.

One thing I love about these kinds of services is that you can attach multiple bank accounts or debit cards as funding sources for your cards, and update the funding source for each virtual card on the fly. So if you'd rather that Netflix charge come from a different account this month (or going forward) its as simple as 2-clicks.

The most popular service of this type is privacy.com, and generally comes highly recommended.

Key Takeaway

On our road to financial independence, the worst thing that can happen is dealing with a banking disaster. While, of course, you should always pay attention to your overall financial picture, including investing for retirement, we hope that these tips help you avoid unnecessary financial catastrophe on your way to freedom.

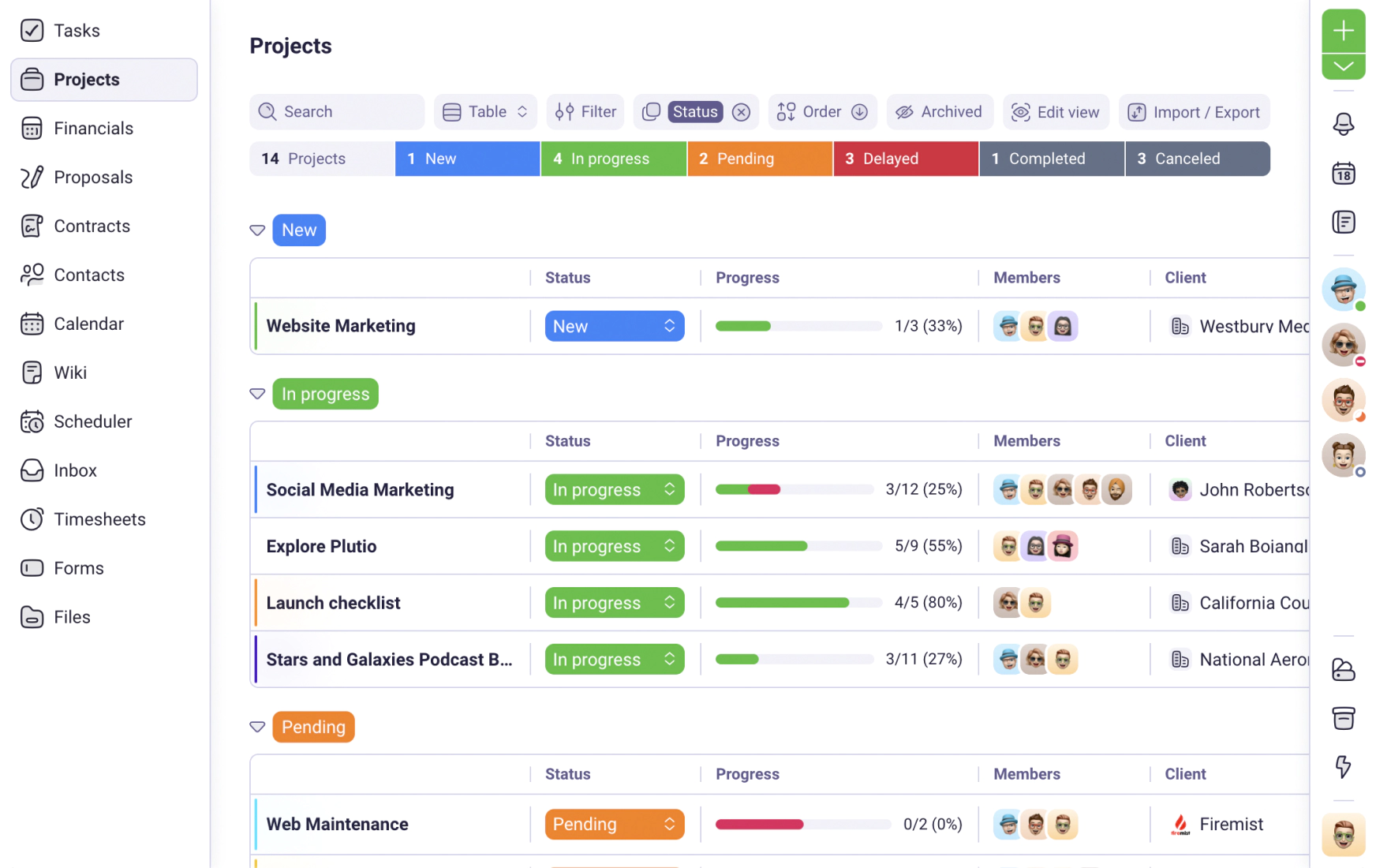

Have you tried Plutio yet?

One app to run, grow, and automate your business with Super Work AI

Try Plutio for FREEStart free today

Your entire business, one login away

No credit card required. No contracts. Just the tools you need to run, grow, and automate your business with Super Work AI.

No credit card required