We use cookies to personalise and enhance your experience.

Having capital for starting a business is not something most people have. In order to create a startup company, many young professionals turn to private or commercial investors. Since closing the deal and getting the investment is not an easy process, you will have to make a plan. Take a look at our list of 6 steps to finding investors for startup businesses.

Develop a business plan

The first step in finding investors for startup companies is developing a business plan. Without having one, there is no way of showing your future investors why they should put their trust in your business. This plan will be the biggest reason why someone will fund you, and it will show investors why they will profit in the long run.

First, you will have to create a summary of your business plan. Before pitching it to a client, you will need to explain the gist of what you plan to do. In case your business can start in a few different ways, this will require plan A and plan B. Having different options and solutions will show your investors that you think about the future and have a backup plan.

When looking for investors like commercial banks, startup owners try to get a loan. This process works in a similar way as with private investors. Instead of pitching a business plan, you will need to fill an application and explain the details of your business. Numerous factors will decide whether you get a loan. For this reason, you should do your research and find out what commercial banks are looking for before investing in a startup company.

Understand what your investors are looking for

There is no universal trick that will help you find investors for startup businesses. While some will approve a loan because of your enthusiasm, others will look into the “plot holes” in your business plan. When looking for investors, you will have to prepare for every option. However, most of them will focus on the following aspects of your business:

• Is your idea (or a product) profitable? You might think it is, but it’s up to you to convince the investors.

• Do you have a detailed business plan? Make sure to check your plan for any flows and prepare to answer the follow-up questions.

• Who do you plan to hire? Do you already have a skilled team of people? If you can prove that you already have people to bring your business success, you will most likely get the investment you are looking for.

• What expenses do you expect? Investors will always want to gain more money than they invested, which will depend on your business’s long-term expenses.

• When will investors start profiting? This question applies to the timeframe for the business to take off. Some startups need more time to advertise and reach success.

Expand your business network

In order to find investors for your startup company, you will have to make more business connections. There are plenty of investors out there, but you’ll need to find the ones who will believe in your business. You can expand your business network in a few ways. The first option is to connect with friends and colleagues from your profession. By doing it, you will increase the chances of finding partners who would start a business with you. The second option is to make a profile on one of the investor-finding websites. Although online listings are also the place where your competitors will be, it’s always smart to post a presentation and wait for the right investors to call.

Build a strategy

Having a strategy to convince investors is an essential part of the process. Without one, your future investors might get the wrong picture of your ideas. For finding investors, you will not only need to have a business plan but also a strategy for convincing potential investors. No matter what your odds are, it’s important to show them you believe that your business will bring success.

Websites like AngelList and similar ones are what you should be looking for. These websites offer a chance for startup owners to present their ideas. If you do it the right way and have a good reason for opening up a business, an investor will come up and get interested.

Your startup business strategy is not all about finding investors. Once somebody offers you a loan, you should be able to bring them profit in the long run. This is why you should calculate your expenses and potential profits, so you can predict whether investors might be interested.

Prepare for meeting clients

Finding investors is one thing, but dealing with them – it’s a different story. When looking for investors for startup companies, you must prepare for presenting your ideas. Also, get ready to negotiate, since the investor will put their profits first. Before meeting up with them, you should make a plan and decide which deal is going to work for your business. If there are a few solutions, write them all down. The process of closing the deal can take some time, which is why you will need a backup plan. No matter how good your ideas are, investors might have different opinions. While communicating with them, your job is to convince them that your partnership will be a win-win situation.

Explain why clients should invest in your business

In a sea of small-business owners, it’s not easy to stand out, especially when it comes to finding investors. Since the market is filled with business owner wannabes, you will have to think of some trick up your sleeve. The first thing you’ll need to do is to do your research and see what the competitors have to offer. If the market is too competitive, you might lose the advantage and the chance to get the investment.

To sum up, finding investors for startup businesses is not an easy process to handle. With so many factors in the game, you will need to focus on your long-term goals and ideas you firmly trust in. Keep in mind that the investment you get will only be the starting point of running your business. This is why you should stay with both feet on the ground, do the research, and put in hard work. After all, being your own boss is not an easy job, but it’s the best career path for plenty of young professionals.

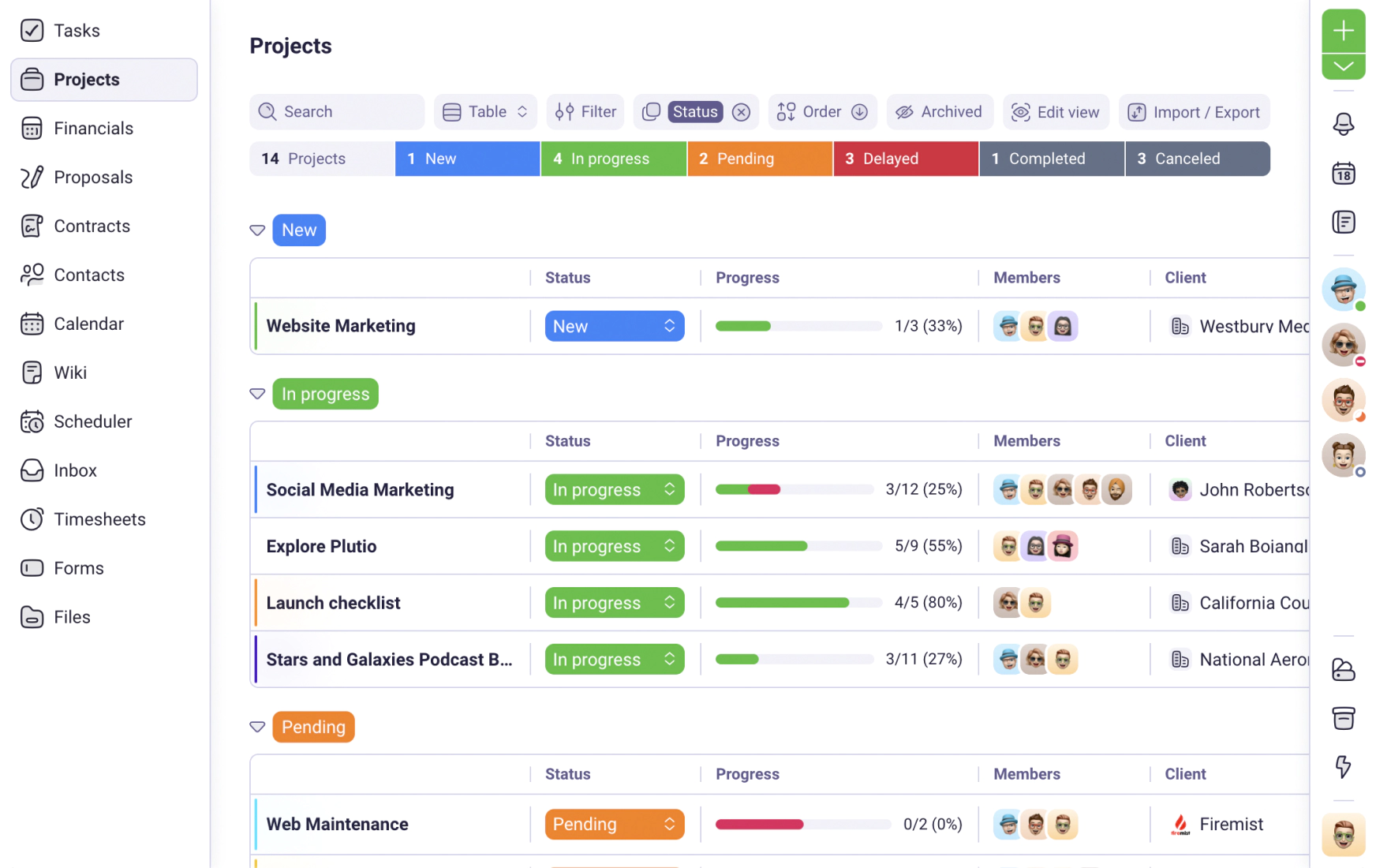

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required