We use cookies to personalise and enhance your experience.

8 Ways freelancers can save for retirement

November 24, 2020

If you’re a freelancer, and if you’ve ever wondered how you’ll save for retirement, then you’re not alone. In fact, approximately 15 million people in the U.S. have chosen this path of being a freelancer in various industries. Why? Because freelancing allows people to have a flexible schedule that can change weekly.

Though, despite the freedom that freelancers have, they still have to regulate their budgets and take charge of their own finances, insurance, and retirement savings. With that said, here are 8 ways to figure out your financial situation, and work towards saving for retirement:

1. Fully Realize Your Situation

“First, you must fully understand your financial situation,” says Javier Anderson, a lifestyle writer at Writemyx and 1 Day 2 write. “For many freelancers, they would like to save up for retirement, just like traditional workers. However, things like health insurance and meeting their basic expenses are often a reality for them that they don’t have the luxury to save or buy out of pocket the same protections as traditional workers. Therefore, a freelancer must set up these protections on their own. In fact, there are many programs that can help you design a retirement savings plan based on your specific life and needs.”

2. Set Aside A Percentage From Your Pay

Next, think of how much of your paycheck you should put away. In truth, the percentage varies. Though, it’s still important to get to saving RIGHT NOW, and then increase your aimed savings amount from there. According to a 2014 study from the Boston College Center for Retirement Research, a typical household will save about 15% of their earnings toward retirement.

3. Track Your Time

Since time is money for freelancers, they must be able to track your time by finding the right system to work with. Just do a quick Google search, and you’ll see that there are many timekeeping apps that can help you track your time spent working for various clients.

4. Create A Separate Account

A separate account for your freelance business can help you monitor the income that you get from your work. Plus, that separate account gives you the tools to keep track of your business expenses, which is particularly helpful whenever it’s tax time.

5. Create A Monthly Budget

First, take note of your net income, along with your normal expenses. Expenses may include:

- Rent

- Mortgage

- Car or student loan payments

- Utilities

- Groceries

Noting your expenses helps you see how much you need to make from your freelancing. Any wants (not “needs” or “essentials”) can be a separate budget – things like:

- Streaming services

- Dining-out

- Weekend trips

- New gadgets

6. File Your Taxes Quarterly

If you’re self-employed, and are expected to owe $1,000+ in federal income tax, the IRS wants you to file estimated quarterly taxes. And, you must make estimated tax payments if your tax last year was greater than zero. Do this, even if you’re not required to do so, so that you won’t have to pay for a big lump sum annually.

7. Create An Emergency Fund

“According to financial experts, salaried employees must set aside money to cover at least 3 to 9 months of expenses in case of a financial emergency,” says Anthony Flynn, a content blogger at Thesis help and Brit student. “However, if you’re a freelancer, and your pay varies, then consider putting aside money that will cover 9 to 12 months or expenses. 9- to 12-months-worth of money will give you a cushion, if you are between projects, or you take on an unexpected expense.”

8. Data Backups

Finally, freelancers must keep track of their data. Why? Because the last thing you want is a to rush on a project, but then lose your work in the final hour by pressing the wrong button, or deleting it off your computer by mistake.

So, since time is valuable to you – the freelancer – you may want to utilize data backups to ensure that everything is backed up whenever it comes time to turn in your work. You can back up data by using:

- An external hard drive, AND OR

- A cloud-based service

Conclusion

Being a freelancer is one thing, but being able to save for retirement is another thing – one that many freelancers won’t think about, until it’s too late. So, instead of ignoring the idea, you must do something about it now. Make sure you’re putting something away regularly, so that you’ll have a decent nest egg in the future.

Kendra Beckley is a writer and editor at Write my literature review and Cheap coursework. She is also a freelance writer for Phd kingdom. As a business developer, she helps companies enter a new market and build long-term relationships with partners.

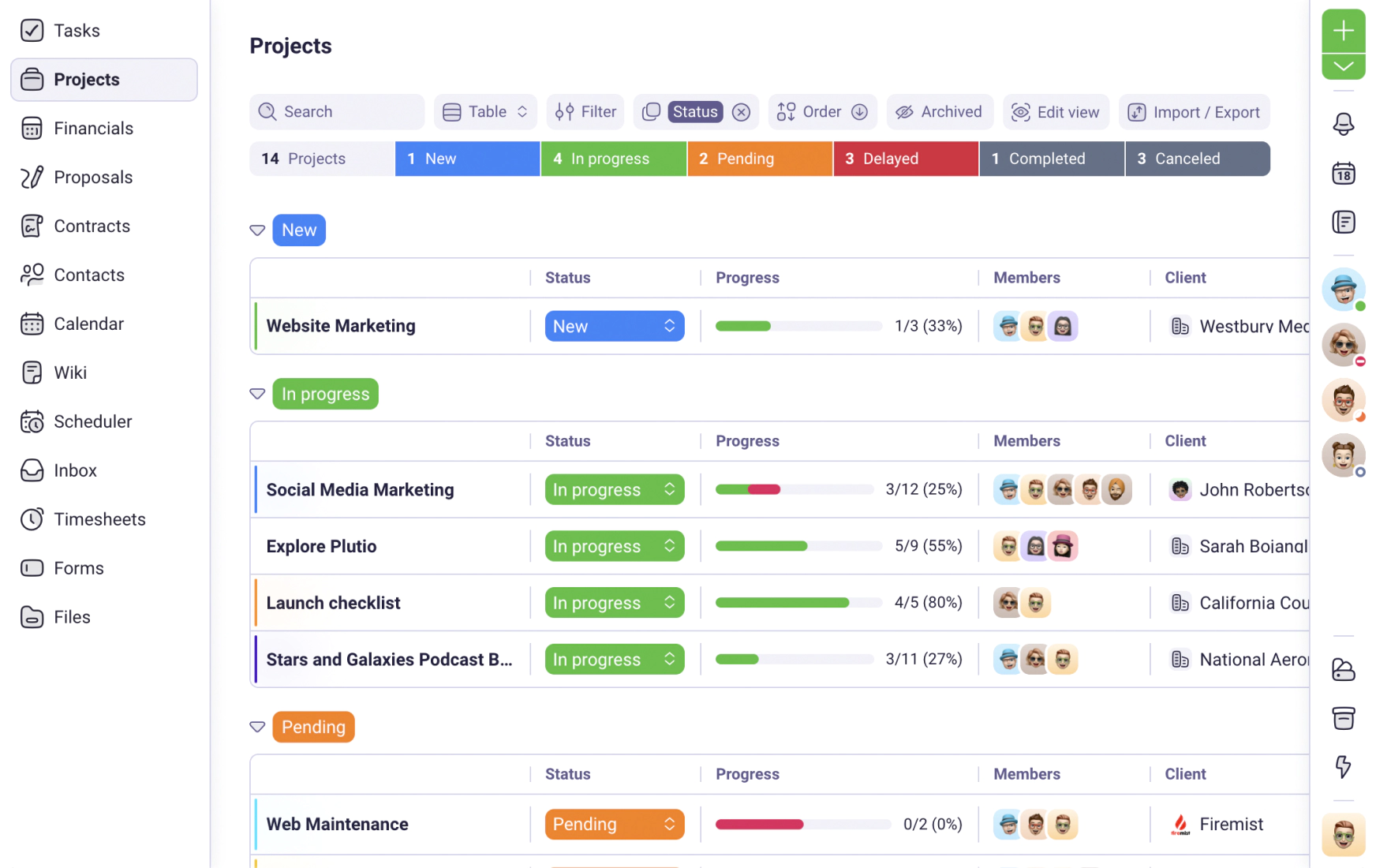

Have you tried Plutio yet?

One app to run, grow, and automate your business with Super Work AI

Try Plutio for FREEStart free today

Your entire business, one login away

No credit card required. No contracts. Just the tools you need to run, grow, and automate your business with Super Work AI.

No credit card required