We use cookies to personalise and enhance your experience.

Getting credit from lenders is not easy for most people. For freelancers, this process can be even harder. Since freelancing rarely includes steady income, it’s difficult to get good credit ratings. Credit score depends on plenty of factors like payment history, length of credit history, and many others. In order to get eligible for a loan and credit repair, there are a few simple steps one can take. If you are a freelancer and don’t have a steady income, this article is right for you. Keep reading to find out how credit repair works and how to improve your credit ratings in a few simple steps.

Credit rating – how does it work?

Before offering a loan, every lender will check your credit score. This action is usually provided by the credit reference agency that will check for numerous factors about your financial status. Plenty of factors will affect your credit score. For example, if you have a steady job, no debt, and pay utilities on a regular basis, these will all help with credit repair. In a few words, the better your credit rating is, the better your chances of getting a loan. If you already took loans in the past, the way you repaid it will also be a big factor. Credit reference agencies will check if your payment history was regular, so they can determine whether you will be a trustworthy payer in the future.

When it comes to the determining factors for getting a loan, we should mention the two most important ones. First, if you have little or no credit history, the loaner will have no actual proof that you will be a reliable payer in the future. This might seem like an irony, but they will see you as a person who never handled a loan before, even if you pay all of your bills on time. Another, most obvious factor that affects your credit ratings is poor credit history. If you were late with your payments before, lenders could take it as a sign you won’t be able to pay up on time.

So, is there a way you can repair your credit score and become an eligible payer? If you are a freelancer, this process could take a while. Here are some simple steps you can use to help with your credit repair.

Cancel unnecessary accounts and cards

Since lenders will pay close attention to your credit history, this step might be necessary. For credit repair to work, you will have to get rid of unnecessary accounts and unpaid cards. Freelancers usually have multiple sources of income, which is why using a few different cards is common. However, this will not be an upside for credit reference agencies. On the contrary, there are better chances of credit repair when your income is visible on one bank account. Your payment history is much easier to track this way.

Once lenders check your bank accounts, they will also look for the amount you are earning. Needless to say, you will need to show regular income via your bank account card in order to prove you are eligible for credit. If you are working as a freelancer, getting paid larger amounts from one client will look better for your credit score. Most times, this is not something freelancers can count on, which is why they rely on their good credit history as proof to show the lenders.

Pay your bills with a debit card

Another smart way to convince lenders to offer you a loan is to pay your bills with a debit card. All the transactions that you make will be good proof that you have regular income and pay your bills on time. Keep in mind that any missed or delayed payment will show with the credit reference agency. In case you have multiple cards for multiple incomes, choose one debit card and pay all your bills with it.

Present proof of your income

Credit repair is not a simple thing to achieve, especially for freelancers. However, showing proof of your income will be one of the determining factors. If you are thinking about getting a loan, you will have to show that your income is regular and paid through a bank account. So, working freelance for cash will not be going to work for your credit repair. Instead, make sure to book reliable clients with whom you can sign a long-term contract.

Many freelancers are paid on a weekly basis instead of once a month like regular employees. In case you can’t show proof of regular income, there is another way to raise your credit score. Being a regular taxpayer will help you show your proof of income. As a freelancer, you will have to present proof of your last year’s taxes paid. Also, lenders will validate your old tax return as proof of your income.

Starting your own business helps with credit repair

If you are working as a full-time freelancer, starting your own business can help you look like a serious payer in lenders’ eyes. Opening a freelance business will automatically make you a self-employed person, which will prove you have a regular income. Also, having a business will seem more legitimate than getting paid sporadically by different clients. Besides credit repair, starting your own business will have another benefit. This action implies plenty of tax benefits that can improve your budget.

Maintain good credit ratings

With all the steps you can take to repair your credit score, this one is probably the most obvious one. In case you already took a loan as a freelancer and want to apply for another one, there’s a simple thing you can do. What matters the most to lenders is how regular you will be with your monthly payments. This is why you should make sure to maintain good credit and show good credit habits. If lenders see that you are able to pay off your loan regularly, this will help with your credit repair for sure.

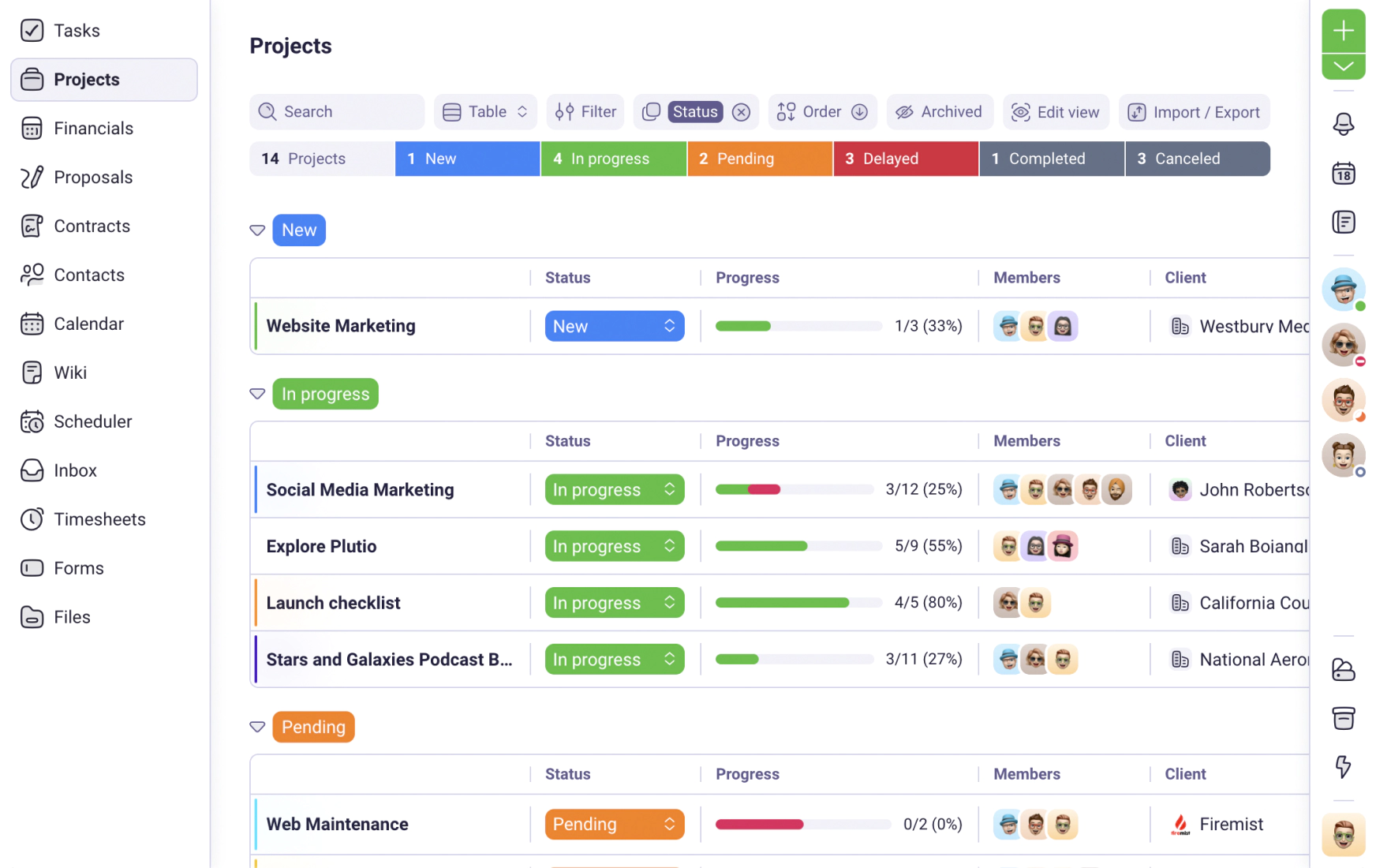

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required