We use cookies to personalise and enhance your experience.

Working as an independent contractor has plenty of benefits, which is why many people decide to take on this freelance job. Unlike one’s company employee, a 1099 contractor works independently, which gives the person certain freedoms. The benefits of being an independent contractor mostly apply to the finances and legal status. So, if you started your own business and want to learn more about your rights and obligations, keep reading. Here are some facts you should know about the upsides of working as an independent contractor.

What is the definition of an independent contractor - 1099?

There are two types of freelance contractors – the W-2 and 1099. These codes are there to represent the differences in which contractors work and handle their taxes. As W-2 positions apply to employees, their taxes and finances are usually handled by their employers. On the other hand, a 1099 contractor works independently (as a freelancer), which is why their job has plenty of differences when compared to W-2. They might be doing the same job, but their finances, contracts, and benefits are not the same.

The main benefit of working as an independent contractor is the freedom to choose their own projects. Since this is self-employment, their work is not dependent on one employer. Instead, a 1099 contractor is a freelancer who chooses their own projects and handles finances as well. Independent contractors often work as consultants for other companies, freelancers, or entrepreneurs.

The major difference between W-2 and 1099 reflects in how IRS sees them. While employees have their companies handle the taxes, independent contractors have to rely on themselves. Luckily, there are plenty of benefits of being an independent contractor. Let’s see how one can benefit from this type of self-employment and learn more about its benefits.

Benefits of being an independent contractor

Being self-employed has plenty of upsides. Most of them apply to the financial part of the work. Here are some of the biggest benefits of being an independent contractor.

The pricing

One of the best news for every 1099 contractor is the possibility to form their own pricing range. No matter which service a contractor is offering, it’s their job to say how much money they want to charge. For freelancers with lots of work, this possibility can pay off big time. However, higher rates will also imply higher taxes, which is something most freelancers know. Unlike W-2 contractors, self-employed ones are not supervised by a boss or a manager. This is why 1099 contractors are solely responsible for getting clients, as well as forming the pricing.

Taxes

Working freelancers have to pay taxes just like regular employees. However, the basic taxes for an independent contractor are lower. If you want to be your own boss, dealing with the paperwork might be messy, but this type of employment can also be a good financial decision. The taxes for freelance contractors are not necessarily lower, as they are more flexible than for the company’s employees. 1099 contractors can get support when paying taxes, especially after deducting their work-related expenses. For example, paying for office space, computers, work-related supplies, and using other inventory could all be considered when calculating taxes.

Benefits provided by clients

Even though 1099 contractors are self-employed, they can still get benefits from other people. In their case, these people are not employers but clients. Depending on the professional field a freelancer is working in, they can expect educational benefits, health insurance, and others. Some clients who hire freelancers will cover travel costs, as well as provide other benefits for their work.

How to get the benefits for 1099 freelancers?

When it comes to calculating finances, it’s one of the most confusing tasks every freelancer has to encounter. Luckily, every 1099 contractor can ask about the employee benefits when negotiating with a client. Even though some companies will not offer these benefits from the start, there is often room for negotiating the deal. For example, if you are about to work closely with other employees from your client’s company, you could get your travel expenses covered. Also, health and work insurance are standard benefits for contractors who are dealing with risky jobs.

If you are a freelance contractor, keep in mind that your client could have some benefits that their company provides. Whether you can ask for them will depend on the nature of your work and the number of working hours, you agree upon.

How to apply for the benefits?

Working with clients can be much harder when you are a self-employed person. In order to get the most out of the deal with a client, you should get to know your rights and opportunities. While talking to a client, you should make sure to stay flexible, but also be honest about the benefits you are looking to get. If you are offering a service to the client, your work could imply risky tasks, plenty of travel hours, or similar situations. If you avoid asking about the benefits, you could end up providing more time and effort for the client that you are paid for.

For this reason, the best way to get benefits as an independent contractor is to know what to look for. If you have friends or business contacts who are 1099 contractors too, ask them for their opinion. Some of them might let you know more about the benefits they’ve got. Besides, you can always consult a staffing agency or look for a new job with them. Some of these companies offer work and health insurance, as well as free advice for handling your self-employment.

Being an independent contractor is not always easy, especially when it comes to handling finances. Asking for benefits is a good way to save money on work-related costs and increase the overall profit. As you are waiting for your next payment, why not use the benefits and make your job a little bit easier. After all, the biggest benefit of working as an independent constructor is the flexibility to create your own schedule and financial plan.

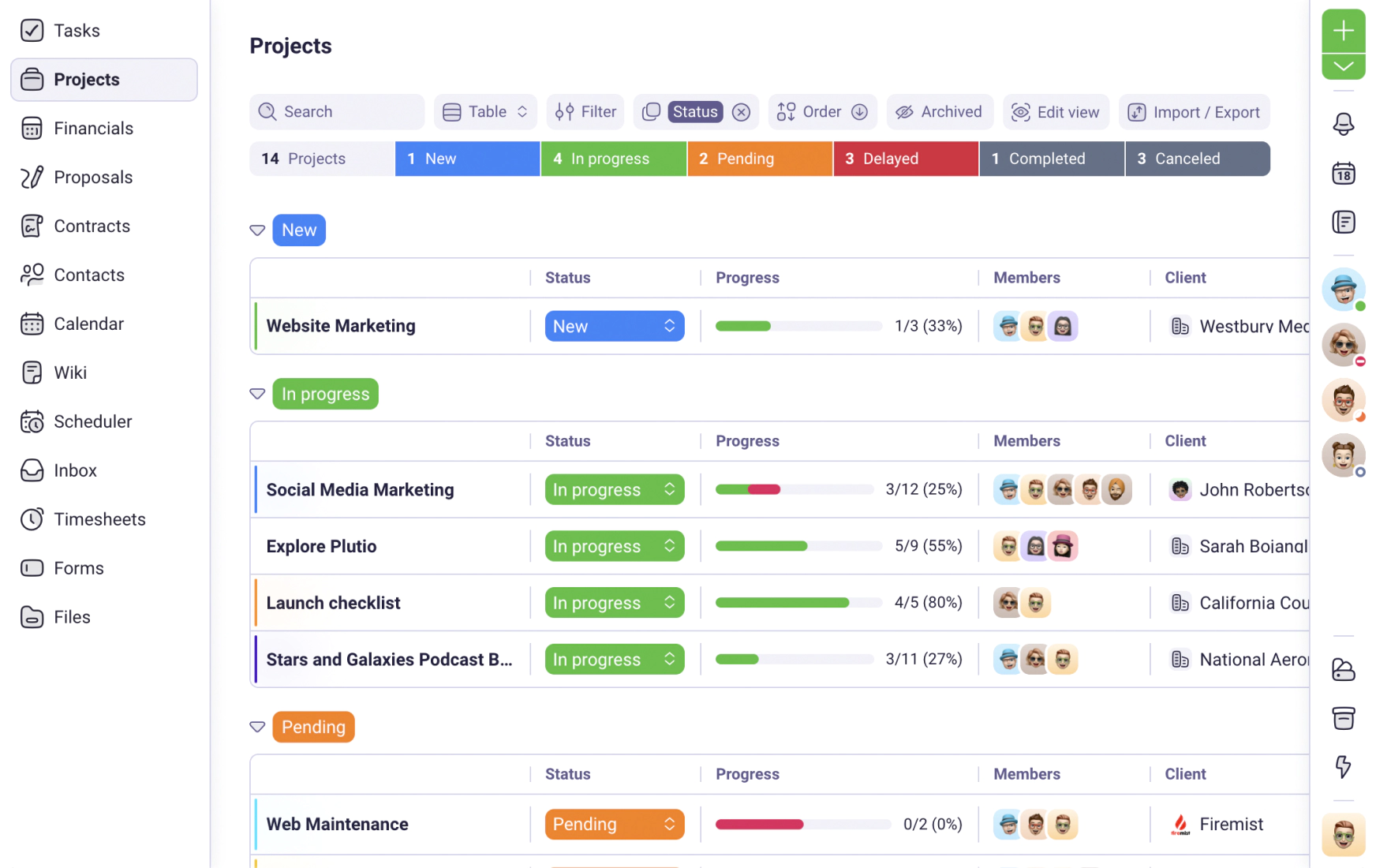

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required