We use cookies to personalise and enhance your experience.

When it comes to merging personal and professional ambitions, there’s nothing quite like being your own boss. Recent years have seen a boom in people ditching the 9-5 and putting their passions to the test. This is especially true of the UK, where small businesses contribute enormously to the economy.

Check out these stats from the UK Federation of Small Businesses:

- At the start of 2020 there were 5.94 million small businesses (with 0 to 49 employees), 99.3% of the total business. SMEs account for 99.9% of the business population (6.0 million businesses).

- SMEs account for three fifths of the employment and around half of turnover in the UK private sector.

- Total employment in SMEs was 16.8 million (61% of the total), whilst turnover was estimated at £2.3 trillion (52%).

- Employment in small businesses (with 0 to 49 employees) was 13.3 million (48% of the total), with a turnover of £1.6 trillion (36%).

The numbers speak for themselves: entrepreneurs are a force to be reckoned with!

Along with the creative rush of starting something new comes a labyrinth of decisions. Some of these decisions - like naming your company, approving a logo or styling a product - are fairly straightforward. Others - such as how to manage your finances - can feel a lot more complicated.

A Startups.co.uk survey revealed the following factors are considered barriers to starting a small business:

- Finance – 50.6%

- Knowledge – 17.7%

- Confidence – 9.4%

- Legal – 5.3%

- Idea – 4.4%

- Time – 3.2%

- Customers – 2.9%

It’s no surprise that financial issues topped this list. That being said - they don’t have to be a barrier.

Of course, you need capital to start a business, and revenue to keep it going. But sales aren’t the only way to boost your income. Understanding where your money comes from and where it’s going, knowing how to file your taxes, and accessing all support available - all these things contribute to your bottom line.

When it comes to small business and freelancer accounting, there’s no better source of information than those who do it for a living. We’ve put together a simple, five-step guide to help you navigate this process - and set you on a pathway to success!

First thing’s first...

Open a business bank account

You’ve heard the saying “Never mix business and pleasure.” Whether or not this timeless (and somewhat cynical) adage is true for every situation, it definitely applies to managing your money.

Keeping your business and personal finances separate is critically important for a number of reasons. The benefits of doing so - as well as the risks of failing to - can be found in detail here. Think about your closet or kitchen pantry. When it comes to finding that key ingredient, or pulling out that favourite shirt, organisation is key. While keeping cupboards tidy might be easier said than done, separating personal and business transactions is usually more straightforward.

Most High Street banks offer business bank accounts. Newer digital challenger banks also offer business bank accounts and some, like Tide, exclusively cater to SMEs and freelancers. Your current personal bank likely has a range to choose from.

Some people find it easier to have both personal and business accounts with the same bank. Having said that - it’s good to shop around. Banks often have different rates, including fees and overdrafts. Do you research to make sure you’re getting the best value for money!

Once you’ve opened an account, it’s time to make use of that new debit (or credit) card. Paying for company expenses using your business bank card will help build your credit profile - handy if you ever decide to take out a business loan. You should also use this account to pay yourself a salary. That way, you can claim your own wage as a business expense, and knock it off your end-of-year profits (For more information on how to pay yourself, see our respective guide for Sole Traders and Limited Company owners)

Top Tip: There are different accounts available depending on your registered business status. For more information, head over to our blog about Sole Trader vs Limited Company status to see which works best for you.

Get Tax-compliant

This is arguably one of more confusing (and less pleasant) aspects of running your own business. Some of the most pressing questions are:

- What forms do I need to complete?

- What taxes do I need to pay?

- When and how do I need to pay them?

The answers to these questions vary depending on your registered business status. Tax regulations differ for sole traders and limited companies. It also depends on which accounting system you decide to use: Cash Basis or Traditional (accrual).( If you’ve yet to make this choice, you might find our guide on the topic helpful).

Here’s a quick peek at the most common forms you’ll need to complete:

- Self Assessment forms and helpsheets for self-employment and partnerships

- Self Assessment: Partnership Tax Return (SA800)

- Self Assessment: self-employment (short) (SA103S)

Regardless of your set-up, a Self Assessment must be filed with HMRC every year by 31st January - although you’ll want to get it done as early as possible to avoid delays (and resulting fines). A Self Assessment helps HMRC determine how much Income Tax and National Insurance needs to be paid on any income which isn’t taxed at the source, such as in a PAYE scheme.

You’ll need to report your income, as well as your expenses (to find out what qualifies as a valid business expense, visit our handy guide).

The fastest, simplest way to file your own Self Assessment is online. Again - avoid leaving this till the last minute. The process might seem straightforward, but delays can always occur (for example, if you lose your activation code). Give yourself plenty of time to get it right.

Top tip: You can find a more in-depth explanation on this in our Self Assessment FAQs guide. Or if you’re looking for further support, Addition offers Self-Assessment filing as an add-on for our CORE package. Give us a call and let us help!

Get your systems sorted

If your business was a building, then a solid bookkeeping system would be its cornerstone. Even if you’ve only just started trading, it’s never too early to put your financial records in order. Keeping all your data organized and regularly updated is the most important thing you can do for your business - especially if you want it to grow!

We’re not talking about a couple spreadsheets and a box of receipts. Manual bookkeeping methods like these are not only incredibly time-consuming - they also leave a wider margin for human error (if you’ve ever had to manually add up 12 months worth of individual transactions, you’ll know what we mean here).

When it comes to bookkeeping software, you’ll be glad to know you’re spoiled for choice. There’s a wide variety of tools to choose from (for our top recommendations, check out our extensive guide).

When deciding which tool is right for you, here are some questions to ask yourself:

- Is it cloud-based?

Cloud-based software means all your data will be stored (securely) online. It will also automatically be saved in real-time - meaning it's safe from any random crashes or bugs.

- Is it intuitive?

A good bookkeeping app should be a friend, not an enemy. Its interface should be simple and easy to navigate. For example, are all the main features in one main menu tab - or do you have to wade through a sea of subcategories to find them?

- Is it good value?

This doesn’t necessarily mean “Is it cheap?”. What it means is: “What can it offer me?”. Sure, you could take out the cheapest DIY plan, but does it actually meet your needs? Can you create and send invoices? Is there a Chart of Accounts? What about receipt storage or expenses tracking?

Perhaps the most important question to ask is: “Can this software grow alongside my business?”.

When the time comes to scale up, the last thing you’ll want is the headache of switching your books to a new system (although we can take care of that for you, if you’re interested). Before committing to any software, check the level-up packages and pricing to ensure they have affordable, comprehensive plans for growing businesses.

Top Tip: There’s a lot that goes into setting up a bookkeeping system. If you’re keen to make the most informed decision possible (as well as learn how to make your software work for you, head on over to our blog on the topic!

Hire an accountant

Yes, you read that right. And no, accountants aren’t a luxury only accessible to giant corporations or wealthy individuals. In fact, research by the Institute of Chartered Accountants showed that the vast majority of SMEs surveyed (with less than 250 employees) made use of accounting services (for more myth-busting facts about accountants, click here).

You might be wondering what you need an accountant for, especially if you’ve gotten a handle on your bookkeeping. Here’s the thing: accountants are not bookkeepers. Bookkeeping is all about recording and organizing the numbers. An accountant, on the other hand, takes those numbers and puts them under a lens. Their job is to analyse your finances, assess what’s working, what isn’t - and what COULD.

Hiring a good accountant is a perfect example of “spending money to make money”. It’s an investment in the future of your business. An accountant will work with you to plot a growth trajectory, cut unnecessary corners and get you all the benefits that you’re entitled to.

Here are just a few of the ways that hiring an accountant can boost your bottom line:

- They can prevent mistakes

With everything that small business owners have to juggle, it’s inevitable that a ball gets dropped every now and then. And while some mistakes can be corrected, others - like a late or inaccurate tax filing - can end up costing you dearly.

An accountant can safeguard you against these errors - which will save you time and money!

- They can save you stress

Sure - you could just take up painting, or practice yoga. But when you put the brush down, or untangle yourself from Crow Pose, there’s still a proverbial mountain to climb. The peace of mind that comes from knowing someone else (who’s very capable) is taking care of things can’t be underestimated. It also means you can focus that mental energy into doing what you really love (like growing your business...and mastering that headstand).

- They can save you money

This isn’t the paradox it seems. HMRC’s fines for late Self-Assessment filing start at an unforgiving £100. Having an accountant ensures that you’re 100 percent tax-compliant - meaning you not only meet the deadlines, but all your information is accurate and up-to-date.

Accountants are excellent analysts, as well. They’ll use the details to frame a bigger-picture outlook for your business. If there are tax breaks or relief schemes you’re entitled to, your accountant will help you get them.

- They can help you grow your business

This - with bells on.

One of the main reasons that entrepreneurs make use of an accountant is to scale up. They can tell you when and how to take that calculated leap - for example, changing your trade status, taking on employees, investing in R&D, and reaching out to accelerators and VCs for funding.

If you want your business to level up, you need a good accountant.

Whether you choose to outsource your accounting or manage it in-house is entirely up to you. Either way, opening a business account, registering your trade status with HMRC and setting up a competent bookkeeping system are all essential steps to take when starting out.

Want some help with that?

Starting a new business is exciting and rewarding. It also requires a lot of legwork, elbow grease and dedication. Circling back to the Startups survey, Knowledge and Confidence came in hot on Finances tail as top barriers to entrepreneurs. Many small business owners are experts at their trade, yet find navigating the red tape a bureaucratic nightmare.

If you’d rather invest your energy in giving new customers the five-star treatment, developing new ideas and generating sales, you’re not alone. Out of six million UK small business owners, 99.9 % have reported making use of an accountant. For some, it’s an annual investment. Others come to an accountant once a year when tax season looms on the horizon.

Addition’s CORE plan (which you can get for £99 a month) can help get you started. We’ll provide you with the tools and support you need to get going. And since we know there’s no one-size-fits-all business model, we let you tailor our plans as well (think main menu + side orders).

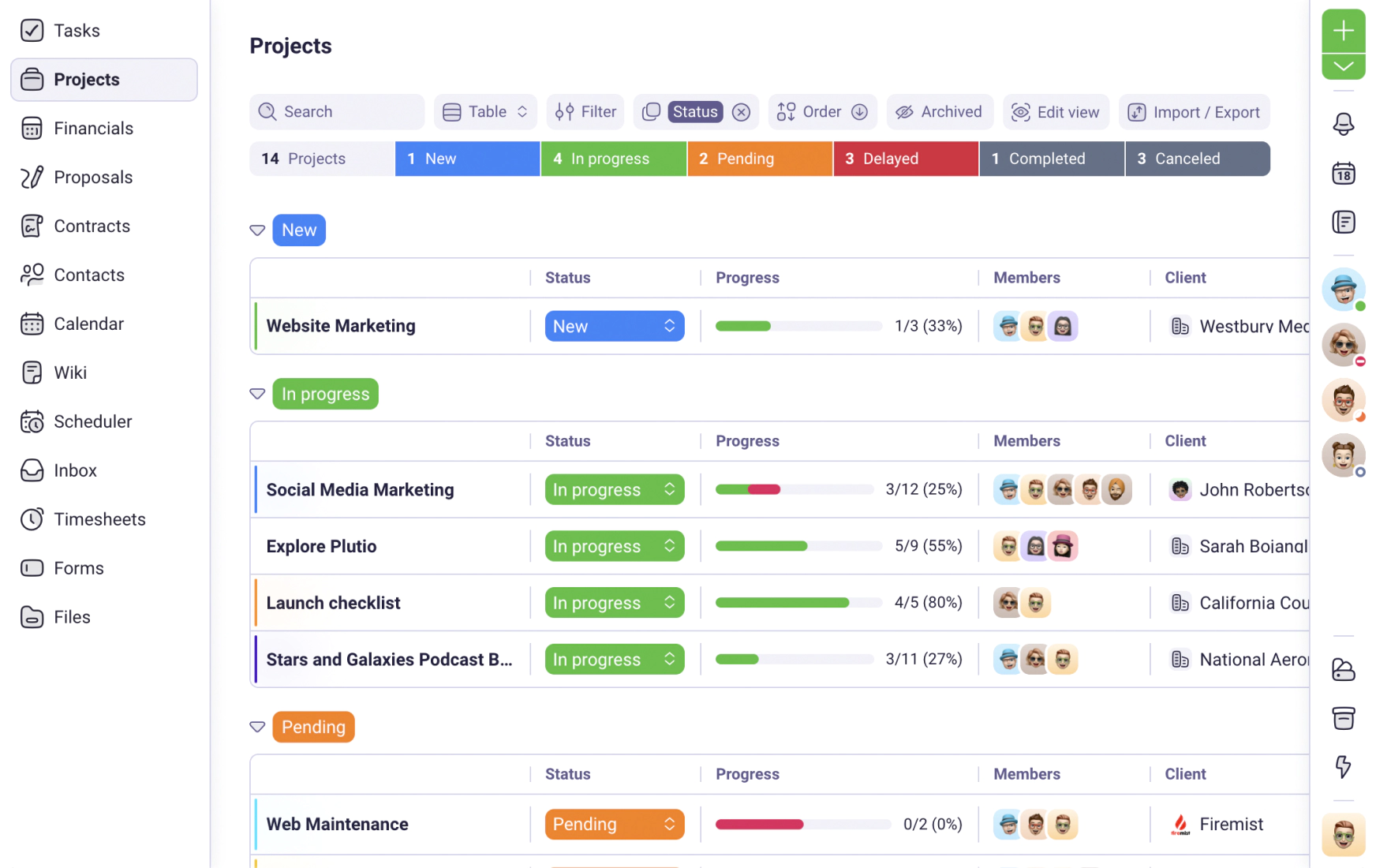

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required