We use cookies to personalise and enhance your experience.

Do I Need an EIN when Freelancing?

July 17, 2021

Do I need an EIN as a freelancer? No. You do not need an EIN when working as a freelancer. You're only required to obtain an EIN once you have employees and so many freelancers decide to use just their social security number.

If you are a freelancer, you might be wondering whether you need to obtain an EIN (Employer Identification Number). You hear about it everywhere, and you are not sure where to begin or how it can help you make your business finances less complicated.

If you worked for a long time under 1099, you might get asked to get your EIN and your Social security number for tax purposes. But do freelancers really need this? Is getting this number mandatory?

Is EIN beneficial for you as a freelancer? You might be pleasantly surprised by the response.

Let us explain everything in this comprehensive guide on what getting an EIN means for you, how to get it, and which mistakes to avoid.

EIN definition

An Employer Identification Number is a number issued by the IRS to all business entities that applied for getting one online via their website. It is a unique identifier consisting of nine digits, and it helps with identifying and tracking the tax responsibilities of business entities.

Which business entities often use EIN? It is used both by companies and solopreneurs. Obtaining an Employer Identification Number is free and pretty easy to get - never use a third-party website to obtain this number, or you risk getting scammed.

In fact, there are many ads out there trying to sell you a service for applying for an EIN number, but as you'll see, it's a straightforward process that anyone can do themselves. Since IRS does not charge for obtaining an EIN, you do not need to spend money on third-party services

Applying for an EIN helps IRS obtain information about your income from invoices. It pertains solely to your business finances, not your personal information such as credit score, medical records, and more.

Do freelancers need EIN?

If you are thinking "Do I really need EIN" and you are working as a freelancer the answer is - only if you want to. It is not mandatory for you to have it if you are a freelancer. Many freelancers are simply comfortable with using their social security numbers. Yet it is also becoming a business practice for businesses to ask for EIN and if you want to consider getting your EIN, we will also mention some of the benefits that can help you make up your mind.

According to the IRS website, you are obligated to obtain an Employer Identification Number if you are involved in the following types of organizations: trusts, farmers cooperatives, real estate investments… but these are often not connected with the world of freelancers which mostly revolves around I.T. technologies.

Which are the pros of getting your EIN as a freelancer?

Let’s focus on the pros of EIN when freelancing:

- Best of both worlds - you can finally enjoy your business and personal life. Losing your EIN is not nearly as dangerous as getting your data leaked and your identity being stolen.

- Obtaining an EIN helps non-US citizens to establish US-based businesses.

- With an EIN, it's easy to make your self-employed freelance business tax-safe. The EIN will come in handy in the first year of your freelance business, as you will need to claim freelance income if you earn more than $400 a year.

- You want to use a DBA (Doing Business Name) instead of your personal name to do business

- Having an EIN for your DBA also allows you to apply for bank accounts under the DBA name

- If you need additional help, having an EIN can enable you to hire employees.

- It can help you with establishing your credit history. Great credit history can speed up getting the loans as well!

How to Get an EIN as a Freelancer

Getting an EIN is not difficult. You can easily apply for an EIN on the IRS website using the EIN Assistant Tool. However, to apply for an EIN, you will need a taxpayer identification number such as an SSN or an ITIN.

Note: If you are a non-US citizen and do not have either of these, you will need to fax or mail the SS-4 form to the IRS, and you could wait considerably longer (20-45 days) to get a response from the IRS. For non-US citizen EIN applications, it is best to apply via vendors like StartFleet, as they can get the EIN for you in under a week.

Step 1: Use the EIN Application Tool on the IRS Website

Go to the IRS website and find the EIN Assistant Tool (as shown below).

Step 2: Complete and submit the application

Then all you need to do is fill out the application and submit it successfully on the IRS site.

Step 3: Get Your EIN! Be Sure To Save It

Once you have completed the application, you will soon receive a nine-digit EIN at the IRS. There's an option to download the EIN letter, too. Please remember to store this letter safely. If you lose it, you can't get it anymore and would have to request the 147C letter from the IRS.

Mitigating the risk with EIN when you are a freelancer

Being a freelancer carries some unique risks compared to working for a company. Since you are working alone, it is up to you to find and maintain business relationships. Freelancers indeed have more freedom to do what they like and get paid but there are also some sides that are not so great.

The economic situation is constantly changing for example and getting health insurance is never an easy task. Also, freelancers are facing the threat of getting their identity stolen, therefore getting their reputation ruined.

Since freelancers are asked to provide their social security number when submitting the W9 or 1099 form, it increases the chances of getting their sensitive data stolen. Therefore getting EIN can help you decrease this risk tremendously. You can never be sure if your client is cautious enough about your sensitive data.

EIN and PayPal

Having your employer identification number is also important if you are using applications such as PayPal and Venmo. These applications offer easier ways to invoice your clients. And the IRS has more detailed information about payment volumes received through these applications.

You are obligated to keep track of payment volumes and notify IRS if you meet or exceed the limit of 200 annual payments through these applications. The other case is if your annual payment volume reached or exceeded $20000.

The IRS requires Third-Party Settlement Organizations like Paypal to report the total payment volumes of business account profiles whose payments meet or exceed these two thresholds in a calendar year.

Do non-US Freelancers need an EIN?

If you are a non-US freelancer, you can obtain an EIN as well. However, the question is, do you need one?

If you have U.S. clients and want to be taken more seriously by potential clients and have the flexibility of allowing your clients to pay you via local U.S. Bank Transfer or Stripe, you might want to get an EIN. Getting an EIN is a precursor to bank accounts and merchant accounts.

Getting an EIN under your name as a non-US citizen is possible. Still, the benefits would be zero as U.S. banks do not open bank accounts for non-US citizens operating as sole proprietorship.

The best option for Non-US freelancers is to register a Limited Liability Company (LLC) in one of the U.S. states. With an LLC and you being the sole member (owner) of the LLC, you can apply for an EIN for the LLC and subsequently apply for U.S. bank accounts and payment processors like Stripe.

If you are providing your services from abroad (outside the U.S.) and do not have any exclusive agents or employees in the U.S., it is possible to make the LLC tax-free in the U.S. For more information regarding U.S. LLCs, read the LLC For Non-US Residents

Conclusion

We have established that it is up to you if you want to get your EIN when freelancing. It is not mandatory, and if you are still not comfortable with using it, it is completely fine. But as your business grows you might consider getting one.

Getting an EIN can help you establish better credibility and look more professional to your prospective clients. It is not a time-consuming process but it can benefit your business and help you gain even better traction for your business.

Also, remember to avoid getting third parties involved if you decide to get an EIN. Don't fall for the various scams!

FAQ:

How do freelancers get tax IDs?

Many freelancers are comfortable with using their Social Security Number as their tax I.D. "Request for Taxpayer Identification Number and Certification," which provides your employer with enough information. After getting this information, your client or employer can send you a 1099 form used to report your income to the IRS.

Can a Sole Proprietor Have an EIN?

Generally, a Sole Proprietor does not need an EIN. But sole proprietors can also get an EIN if they choose to do so. However, if you work 1099 for a long time, it is recommended that you apply for an EIN to separate your tax reporting.

How to Use Your EIN as a Freelancer

Freelancers can use the EIN just like the Social Security Number (SSN). You can use it for freelance paperwork, tax forms, and even bank account opening. Instead of the SSN, most freelancers use the EIN because of the risk of leaking personal information. Indeed, scammers can steal your EIN and use it for fraudulent purposes. However, the number is not linked to you personally but instead the company. Thus the risks are lower.

What can you do if you want to replace your SSN with an EIN?

You can ask your clients to use a newly completed W9 for their tax and payroll records. Remember to use secure methods for sending this information - not as an email attachment!

Complete the W9 in the same manner as your SSN, but use the EIN instead. Your clients should be happy to make this change and include the EIN instead of your SSN on their year-end 1099-misc statement.

Is freelance work considered self-employment?

As a freelancer, if you earn $400 or more from any single employer in a year, the IRS considers you self-employed and requires that you file taxes as a business owner.

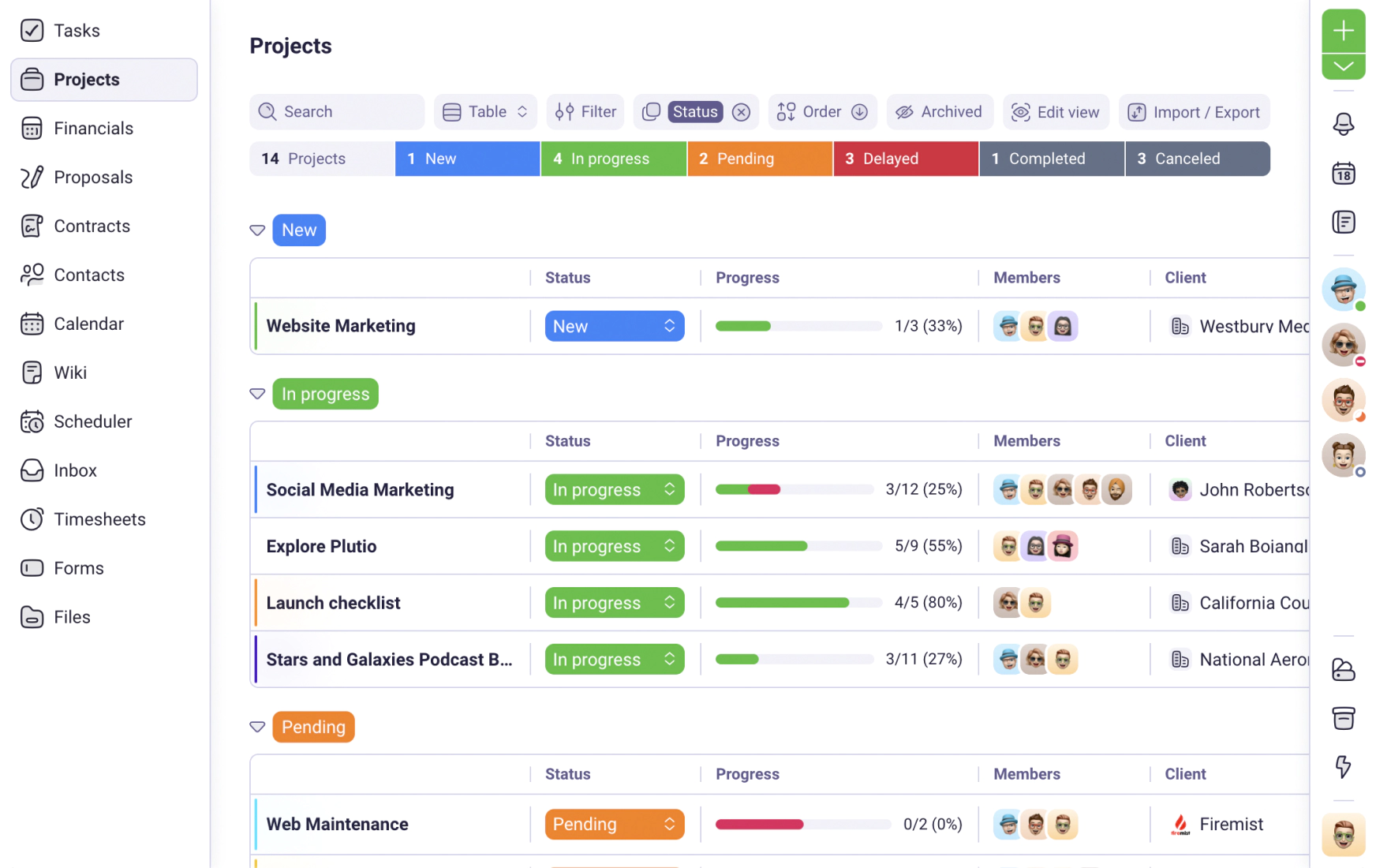

Have you tried Plutio yet?

One app to run, grow, and automate your business with Super Work AI

Try Plutio for FREEStart free today

Your entire business, one login away

No credit card required. No contracts. Just the tools you need to run, grow, and automate your business with Super Work AI.

No credit card required