We use cookies to personalise and enhance your experience.

Being a freelancer means that you are your own boss, a so-called one-man-band. While it’s hard enough to land new gigs and ensure a stable flow of money; you still need to think about the more tedious part. We are talking about finances, of course.

This process is very daunting since you need to cover so many things. How will you monitor your freelance expenses? What about your invoices? Do you track them as well?

The way you manage your finances represents a massive part of your business. You can’t leave that for later, nor can you ignore it as you might get some unpleasant surprises in the form of taxes. Also, if you are not aware of earning and spending, things can get very tricky.

Yet, freelance bookkeeping is not as scary as you might think. Bookkeeping just needs a bit more attention. If you are not sure about your business process, expenses, or you don’t have precisely defined goals - perhaps it is time to prioritize this part.

Whether you are starting or you already gained momentum in your freelancing career - it is always great to sit down and go through the basics once again.

Keep your business and personal finances separated

Before you even begin, remember to keep your business account separated from your private finance account. There are many options available and banks that offer business account packages, so it’s not such a headache.

Freelance bookkeeping - the beginning

In the beginning, remember to be realistic. Unfortunately, some freelancers try to build esteem by doing the worst thing possible - they don’t count all of their expenses. This is not a smart move to make.

When you are starting, it is normal to see numbers in all shades of red. Try to accept things the way they are. It will change. So count all the expenses.

The same applies for your earnings. Document literally everything, every penny you earn. Being realistic and meticulous in this part will help you understand where you are standing - and where you should go.

Freelance bookkeeping will grow more complex over time, so it is essential to have a decent grasp of accounting basics. The detail-oriented you are, the better things will be when the taxes come.

Make a backup for a tax money

This is something you should seriously think about. Taxes are not something you can actually avoid. Once you earn your money, a great practice is to leave 30% of the income for taxes. Then, create a savings account with the name “taxes” - and just forget about that money. You will thank yourself later when estimated quarterly taxes arrive.

You also need to become more familiar with tax laws and tax terminology. With all free resources regarding freelancers, which are often contradictory, you need to be more attentive. Things you need to explore are:

- Quarterly estimated tax

- 1099-K and 1099 misc forms

- Travel, entertainment, and home office deductions

Backup of your files is also important

The days of writing your incomes and expenses in notebooks are over. Today we have a lot of different software solutions that are easy to use.

However, a simple spreadsheet can also do the trick. But what will you do if your system goes down, the hard drive is lost, or the files get corrupted? This might seem like overthinking but bear with us for a moment - you can’t leave anything to chance.

Remember to take time weekly to backup all your files and all your documentation or use cloud-based services. Days of notebooks might be gone but try keeping all of the crucial documents in paper form somewhere safe. Fireproof safe, of course. Again, it is not overthinking, but these things don’t happen only to other people.

If you are using your credit cards for certain business expenses, remember to download these credit card statements.

Save all receipts

Even if you own an accounting software - it is vital to save all the receipts. Yet, you will want to avoid handing a box full of recipes to the IRS.

They also accept photos of your receipts. Bear in mind that receipts tend to fade away after some time. Once you make a business purchase make sure to get a picture of the receipt and save it on your computer or a cloud. Some freelancers even have a separate email where they keep their receipts.

Also, it is important to write down the purpose of the purchases - it will be easier for the IRS to check if it qualifies as a business expense.

Check everything regularly

As your freelance career progresses and you become busier, try to keep everything in order. For example, check your financial status, track your invoices and collect all your receipts periodically. It won’t take too much of your time.

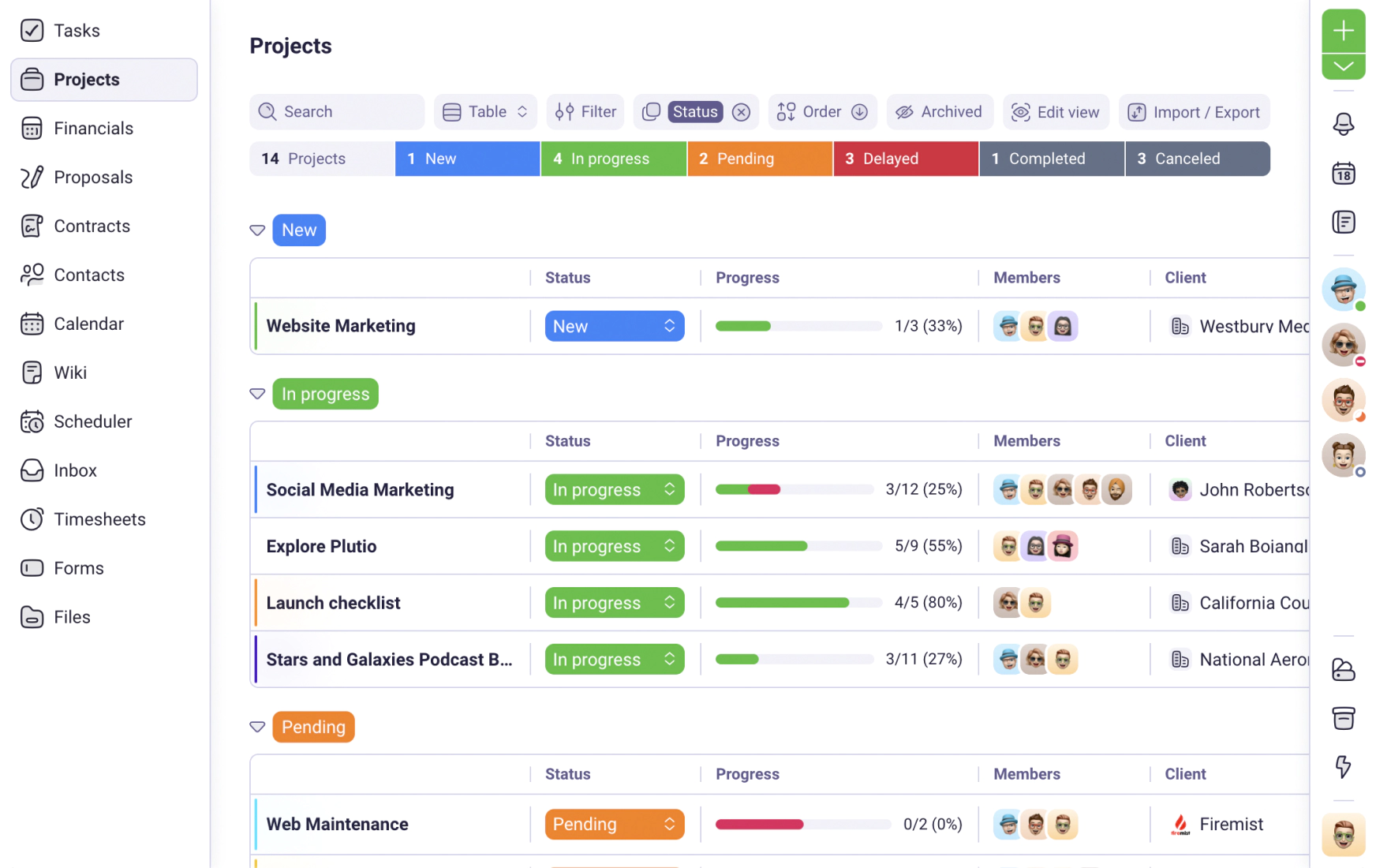

It is always great to automate your invoicing process. Plutio offers a perfect invoicing solution - you will never forget to send invoices again. In addition, you can track your invoices and get notified when they are opened and paid. This will not only save you time, but also make managing your financing process that much easier.

Your business needs to prioritize your cash flow. You might want to look generous to your client but remember to appreciate and value your time. So send invoices the moment the milestones are reached.

Talk with other freelancers

If you need additional information about freelance bookkeeping, it might be best to talk to others like you. Join a community of freelancers from your niche. You are not competitors, not exactly colleagues either, yet you can learn a lot from each other.

If you face some issues or have something to share with your online community, it is a great start. It is always good to learn from someone else’s experiences when you are beginning your adventure. Freelance bookkeeping, right accounting software, process automation - every tip is welcome.

In conclusion

Freelance bookkeeping can get complicated from time to time. You need to have a good understanding of tax laws and knowledge how this aspect of freelancing works. So the first step should be prioritizing your accounting. You need to have a 360 view of the entire process and be realistic.

You know you can count on Plutio every step of the way. We want to see you succeed. From invoicing to winning business proposals, we can help you focus your time and creative energy on landing new gigs and providing outstanding results to your clients. Let us support your freelance career.

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required