We use cookies to personalise and enhance your experience.

There are plenty of perks to being a freelancer. You experience a lot of flexibility, you get to be your own boss, and if you build up a solid client base, the sky’s the limit when it comes to your salary.

According to a 2019 study by ZipRecruiter, the average freelancer works 36 hours per week and makes an average of just over $58,000 each year. That number grew by almost 50% from the average freelancing salary in 2015. Now, thanks to the COVID-19 pandemic, freelancing has become even more prominent. Major businesses are even hiring freelancers to save money and time. As a result, it’s likely the upward salary trend will continue.

While making a living doesn’t really have to be an issue as a freelancer once you have several clients, if you’ve been freelancing for any length of time now, you know that unexpected expenses happen. And, because it’s hard to take time away from work and you’re not sure what your actual take-in will be each month, unexpected expenses can be scary.

What can you do to be prepared? How can you make sure you’re managing your finances in such a way that you’ll be ahead of the game if unexpected expenses come up? Furthermore, how can you save for everything from college to retirement?

Assume Unexpected Expenses Will Occur

One of the best ways to plan for unexpected expenses is, ironically, to expect them. Or, at least, anticipate them.

For example, it’s a rarity for anyone to get through life without experiencing at least one of the following:

- Home repairs

- Seasonal expenses

- School expenses

- Unexpected travel plans

- Pet emergencies

- Medical expenses

- Automotive needs

With that said, it’s wise to assume you’ll need to have money socked away for something, even if you don’t know what it is. This will eliminate any negative shock when something does occur because you’ll be mentally prepared as well as financially safe.

As a freelancer, there are additional expenses you’ll need to consider to boost your business, including marketing, technology upkeep, and insurance. You may also need to take “dry spells” into consideration. When you’re working in the gig economy, there will be times of feast and famine. You should be pre-emptively doing things like saving a percentage of whatever you make for taxes (and it’s a good idea to make quarterly payments), and putting away a percentage into a savings account or emergency fund.

Not sure how much to put away? Things will be much clearer if you make a budget and see not only where your money is going, but how much you really need each month to live comfortably.

Build Your Best Budget

Creating a budget for yourself is necessary if you want to know how much you’re spending each month and how much you need to bring in. Again, because some months of freelancing will be more successful than others, staying consistent with your spending will help you to stay afloat no matter what.

If you’re not sure how to get started with a budget, consider your main expenses. That includes things like rent or a mortgage, a car payment, utility bills, and other amenities if you live in a rental property. Once you’ve added up your largest expenses, you can start to look at smaller things like:

- Dining out

- Shopping

- Entertainment

- Subscription services

The last thing you want is to be in debt as a freelancer. Building a budget will keep you in the know when it comes to your credit card bills and other financing offers you may be a part of. Paying things off on time will also help you to maintain a good credit score. That’s crucial for your personal life and your business, as it will make it easier for you to get a loan if you ever need one to expand, to buy a house, or to complete a large project. Keeping your budget up-to-date will also give you peace of mind during the times in your freelancing career where you don’t seem to be making as much.

Plan for the Future

When you work for a company, you’re usually offered a benefits package — and retirement funds are usually included in those packages. But, you don’t automatically get a 401(k) as a freelancer, meaning you likely have to save for your retirement and plan for the future on your own.

But how can you be expected to save for retirement and have an emergency fund for unexpected expenses, at the same time? Luckily, it’s easier than you might think.

First, you absolutely can have a 401(k) as a freelancer, you just have to set it up yourself. The main thing to keep in mind is that it’s important to understand how much you can personally contribute to your 401(k) each year. One of the best ways to do that is to talk to a financial advisor.

Setting up a specific retirement account like this is a great option because it keeps that money safe until you reach a specific age. You won’t be tempted to use it for unexpected expenses or emergencies, so you can automatically contribute to the 401(k) without a second thought, and actively put money away for emergencies, too.

By setting aside separate percentages of your income, keeping your budget up-to-date, and considering yourself a growing business, you can enjoy the fruits of your labor now, plan for your future, and be comfortable with any unexpected that might occur at any given time.

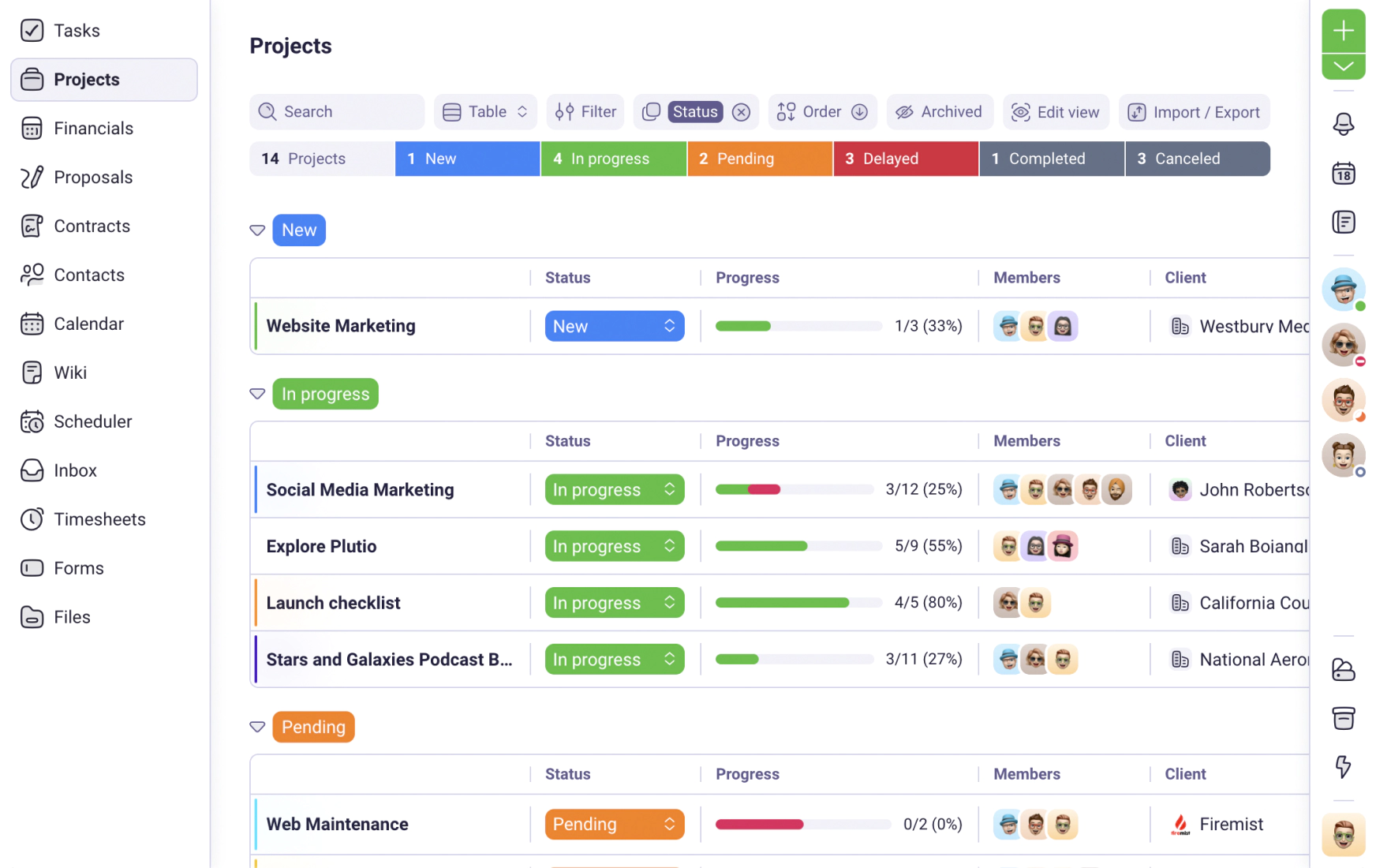

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required