We use cookies to personalise and enhance your experience.

Handling finances has never been a fun job. Whether it’s an entire department or one freelancer handling them, this process always seems to be complicated. Since plenty of people rely on multiple income sources, it’s not easy to handle finance tracking every month. All those invoices, bills, and expenses can be overwhelming, right? If this is something you need to do on a regular basis, you will have a few options available. Having a system will help you organize better and keep track of every little detail. Whether you’re using an excel sheet or an online finance tracking program, there’s a way to make this process simpler. Take a look at how to keep the track of outstanding invoices and expenses with ease.

Why is online finance tracking software the best solution?

Just like the other aspects of the modern business running, finance tracking has evolved. Today, plenty of people rely on various programs that help with calculating, organizing, and tracking their financial reports. For freelancers, online software programs for finance tracking have become the most popular option. However, is using one of these the best option for your business? If you are overwhelmed with paperwork, invoices, and expenses – it might be.

Relying on our computers has plenty of upsides, especially in online businesses. However, switching from one sheet to another while sorting out finances can be tiring, to say the least. If you have plenty of different income sources, invoices, and bills to sort out, an online finance tracking software could be the best solution. These programs are highly customizable and user-friendly - with a quick tutorial, everyone can learn how to use them. So, using an online finance tracking program can be the best way to save time while handling your finances.

Using a finance tracking software - what’s to know

If you decide to track your finances in specific software, you will have to do the research. Although it’s possible to track your invoices and expenses in a simple excel sheet, using software has plenty more benefits. Before you choose the one that suits your business, here are some factors you’ll need to consider:

- Is your data stored online? There are plenty of programs that will store your files online. Basically, most of these software programs are cloud-based. One of the advantages of this system is the safety of your data. If you choose this type of finance tracking, you will be the only person with access to your files. Online document storing is convenient for freelancers who switch to different devices and need access to their files on computers, mobile phones, and tablets.

- Will you be the only person tracking finances? Plenty of programs are designed to work for a team of people. When finance tracking is done by the entire team, it’s better to choose a program that is accessible for multiple users.

- Which features are you looking for in an accounting program? Do you need to track invoices and multiple income sources? Will you need to track your expenses, too? If you need more categories, tables, and features in a program, make sure to find the right one for your needs.

Organizing paper bills and online bills

Sorting out your paper bills

Unfortunately, not all finance paperwork is available online, though most of it is. If you need to successfully track your invoices and expenses, the chances are you’ll have some paper bills to handle. Freelancers often have these all over their homes, since they are not working in a standard office space. The best way to organize this paperwork is to sort it into categories. Both your invoices and expenses can be sorted by date, by month, or year. On the other hand, you should have a separate category for each client you’re working with. As soon as your bills arrive, make sure to place them in a folder with similar documents.

Keeping track of online bills

Unlike sorting out paperwork, online bills are a bit easier to organize. For some users, a simple excel sheet can be enough for finance tracking. However, finance tracking software can be a more efficient solution for bigger companies and multiple sources of income. If you are getting your bills via email, the easiest way to organize them is to make a folder in your inbox. For some, this system proved to be the best way to organize online bills.

Handle reports regularly

No matter which system you choose to use, handling financial reports will always be the most tiring part of the process. If you decide to use software, filing reports regularly will be much easier. After all, why should you keep track of all the due dates when a program can do it for you? Modern technology allows people to develop smart programs that can calculate finances, organize files, and even set reminders. In order to keep track of all the invoices and expenses, this system will help you save a lot of time.

In case you still prefer a simple sheet for finance tracking, make sure to write down reminders for your financial reports. Keeping track of your reports regularly will help you avoid confusion and possible misunderstandings with clients.

Review your invoices and expenses with ease

While you are handling your regular workweek, there’s a chance you can forget to send an important invoice or file a report. Luckily, finance tracking programs are there to remind you of the important due dates. If you keep track of your invoices and expenses regularly, your monthly reports will be easy to assemble.

Handling finances can be overwhelming, but not if you find a system that works well with your business. Instead of working between a few sheets, word documents, and emails, you can simplify your finance tracking. All you need to do is consider all the aspects of your finances, keep track of the paperwork and organize the files regularly. Whether you use a plain sheet of paper or an expensive software program, all you need is a good plan. So, make sure to sort out your financial reports, invoices, and expenses on time.

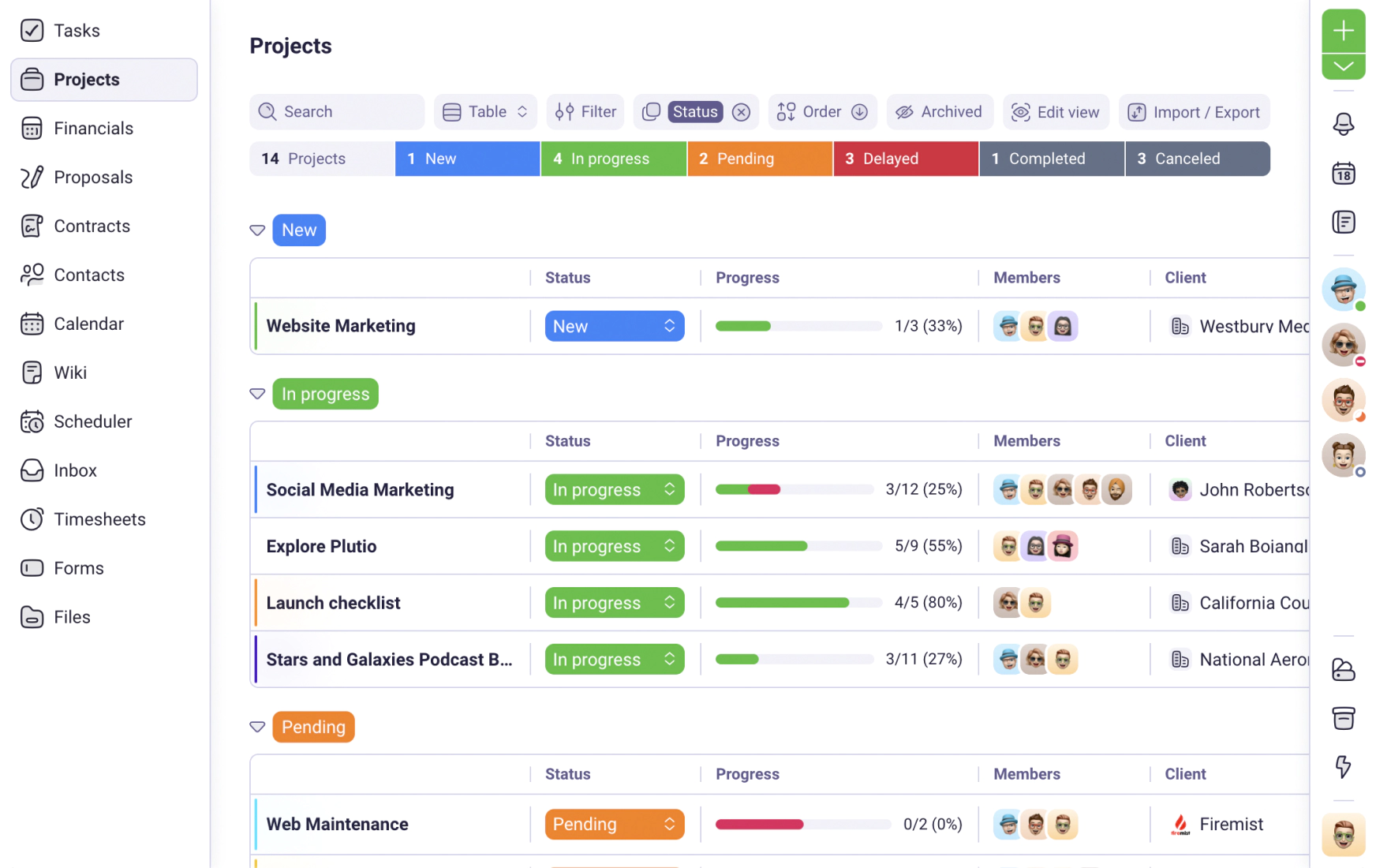

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required