We use cookies to personalise and enhance your experience.

If you run a small business, you’ll know that controlling cash flow is one of your most important management tasks. But, keeping cash coming into the business means ensuring your customers pay you on time — and that’s not always easy.

Sometimes, customers just forget the due date for payment, but other times they may just be reluctant to pay on time. They might be trying to protect their own cash flow by delaying payment or they may have a problem with your invoice which has to be resolved.

Whatever the situation, you need to monitor payment dates carefully and take action quickly if customers haven’t paid by the due date.

In this article, we outline some polite ways to remind your customers about payment without potentially damaging relationships. But, we also cover some of the options available if you don’t get a satisfactory response. And, we take a step back to consider how to streamline your invoicing, monitoring and collection process so it requires minimal intervention to get paid on time.

Send a reminder

When payment becomes due and you haven’t received the money, the first step is to contact the customer to remind them that payment is due. You may decide to wait a couple of days in case a check or other type of payment has been delayed, but after that you must take action as quickly as possible.

There are a number of polite ways to remind the customer when you contact them by mail or email.

- I wanted to check that you received my invoice NUMBER/DATE, which was due for payment on DATE. If you haven’t received it, please let me know and I will resend it.

- I understand that you are probably very busy, but could you please check that you (or your accounts department) have settled my invoice NUMBER/DATE, which was due for payment on DATE.

- My invoice NUMBER/DATE was due for payment on DATE. If there is a problem with the invoice, please let me know so that I can resolve it. If not, I look forward to receiving payment shortly.

- As a regular customer, you’ve always settled my invoices on time. However, I noticed that invoice NUMBER/DATE was due for payment on DATE and I haven’t received settlement yet. You may have just overlooked this, but if there is a problem, please let me know so I can resolve it.

Format for reminder emails

Sending an email as a reminder is a quick and convenient way to jog your customer’s memory. Your email should be polite, but firm. To make sure that the email is effective, there are a number of steps to include:

- Start the email with a clear subject line, such as ‘Invoice NUMBER – payment due on DATE’

- Ask the customer to acknowledge receipt of the email or set a read receipt in your email program.

- Attach a copy of the original invoice – the customer may have mis-placed it.

- Include a description of the work you carried out if it isn’t detailed in the invoice.

- Include a purchase order number, reference or other instructions issued to you by the customer.

- Make sure that the due payment date appears clearly in the email.

- Include information on how to pay, such as your bank account or PayPal details.

Send an automated reminder

If you don’t feel comfortable sending a personalized email, use an automated email from your invoicing program. You can set a schedule for issuing reminders automatically when payment is not recorded on the program.

The reminder will only include basic details such as invoice number, amount, due date, customer reference or purchase order number and payment details.

Although this type of communication is impersonal, compared with an individual email, your customer may feel less embarrassed and more willing to respond.

Follow up the reminder

If you don’t receive payment or any kind of response to your reminder, it’s important to follow up quickly. Here is an example of a polite follow-up.

- I sent you a reminder about an unpaid invoice NUMBER/DATE on DATE. I haven’t yet received payment or heard back from you. I would appreciate it if you could deal with this in the next few days. As a fellow business owner, I’m sure you appreciate the importance of keeping cash flow up to date.

However, if you still get no response, you should follow up again but, this time, the communication doesn’t have to be so polite.

- I’m concerned that you have not responded to my initial reminder and follow-up about my unpaid invoice NUMBER/DATE due on DATE. As payment is now considerably overdue, I would appreciate it if you could settle this invoice without any further delay and confirm payment to me in writing. If I don’t hear from you within X days, I will have to consider further action to recover the money due.

Make phone contact

Although it’s easier to make contact by email or letter, sometimes a phone call can help you secure payment. Unlike emails, customers can’t claim they haven’t received your communication if they answer your call. When you call, there are a few useful guidelines to follow.

- Make sure you are talking to the right person. Your contact may not be the person who pays the bills. It may be someone in the accounts department or a freelance bookkeeper in a small business.

- Explain the reason for your call, giving full details of the invoice, any customer reference, the amount due and the date payment was due.

- Ask the customer if there are any issues preventing payment that need to be covered.

- Ask when the customer will be able to settle the invoice.

- Follow up the phone call with an email, setting out the points agreed on the call.

Options for recovering late payment

If your reminders and follow-ups don’t work, you have a number of options:

- Let your customer know that you will be charging interest on the overdue amount until you receive payment.

- Offer customers a payment plan. This may be appropriate if the customer is facing genuine financial problems.

- Pass the invoice to a collection agency that will take responsibility for collecting payment in return for a fee.

- Arrange a meeting with the customer together with a mediator who will help you come to a mutual agreement over settlement.

- Take your case to a small claims court. Maximum claims and procedures may vary from state to state, so check local guidelines.

Charging interest

If you intend to charge interest, you must notify your customer in writing of the amount of interest – x% and the charging period – x% per day/per week/per month.

Although you may only consider charging interest when you find that payments are overdue, it’s good practice to make customers aware of every invoice, rather than trying to impose the charge after the event.

Payment plans

Offering a payment plan can be useful if you are trying to recover a larger overdue payment. You must set out the terms of the payment plan clearly.

- State how many part-payments you are prepared to accept – payment in 2/3/4 stages

- State the maximum period for each part-payment – 1 payment per week/month

- State the date for final settlement of the total due – payment must be complete by DATE.

- State if any interest will be added to the invoice amount – invoice will be charged at x% per week on the outstanding balance.

Collection agencies

Collection agencies can take over recovery when you have exhausted other methods. They contact the customer and make arrangements for collection of the full amount or part payment.

In return, they retain a proportion of the invoice amount as their fee. This means that you will receive less money in total, but you have an assurance that you will have incoming funds to maintain cash flow.

Mediation

An independent mediator joins the meeting between you and your customer and offers suggestions on the best way to move towards an agreement. The mediator also ensures that the meeting is fair to both parties and is conducted in a respectful way.

Mediation does not offer any guarantees that you will receive payment. However, it may help you and your customer come to a mutually acceptable agreement on part or total payment.

Small claims courts

Suing a customer in a small claims court may seem like a step too far, but it may be the only course left if all other approaches have failed. Before you consider making a claim, make sure that the amount you want to recover is within the limits set by the courts in your area.

The local court may also require you to send the customer a demand letter setting out your intention to sue before they allow the claim to proceed. The demand letter should include a request for payment, together with details of the work, a copy of the invoice, payment instructions and a statement of your intention to sue if they do not settle payment within a specific time.

The detailed approach for making small claims and information on local court regulations is outside the scope of this article, but you’ll find a useful guide here on collecting outstanding invoices.

Avoid late payments

Reminders and other actions are essential when customers forget or fail to pay, but you can take proactive action to reduce the risk of late payments. By issuing upcoming payment reminders, you can help customers plan their own payment schedules.

Depending on your payment terms, you can schedule a series of automated reminders.

- Send a reminder one week before payment is due - Payment for invoice NUMBER is due next week on DATE. I look forward to receiving payment. If you have any queries on the invoice, please let me know.

- Send a reminder on the due date - Payment for invoice NUMBER is due today DATE. You can pay by check, bank transfer to ACCOUNT DETAILS or OTHER METHOD. I look forward to receiving payment today. If you have any queries on the invoice, please let me know.

- Send a reminder two working days after the due date - Payment for invoice NUMBER was due on DATE. You can pay by check, bank transfer to ACCOUNT DETAILS or OTHER METHOD. I look forward to receiving payment by return. If you have any queries on the invoice, please let me know.

Clarify your payment terms

If you find you are regularly encountering late payments, it may help to clarify your payment terms and include information on any discounts or penalties for late payment.

- Payment terms are xx days from date of invoice.

- A discount of x% is available for payment within xx days.

- Late payments will incur interest charges of x% per week.

Making your terms clear on each invoice will ensure that your customers are aware of their obligations for payment. Offering a discount for early payment will help your cash flow, while stating the charge for late payment will encourage customers to pay on time.

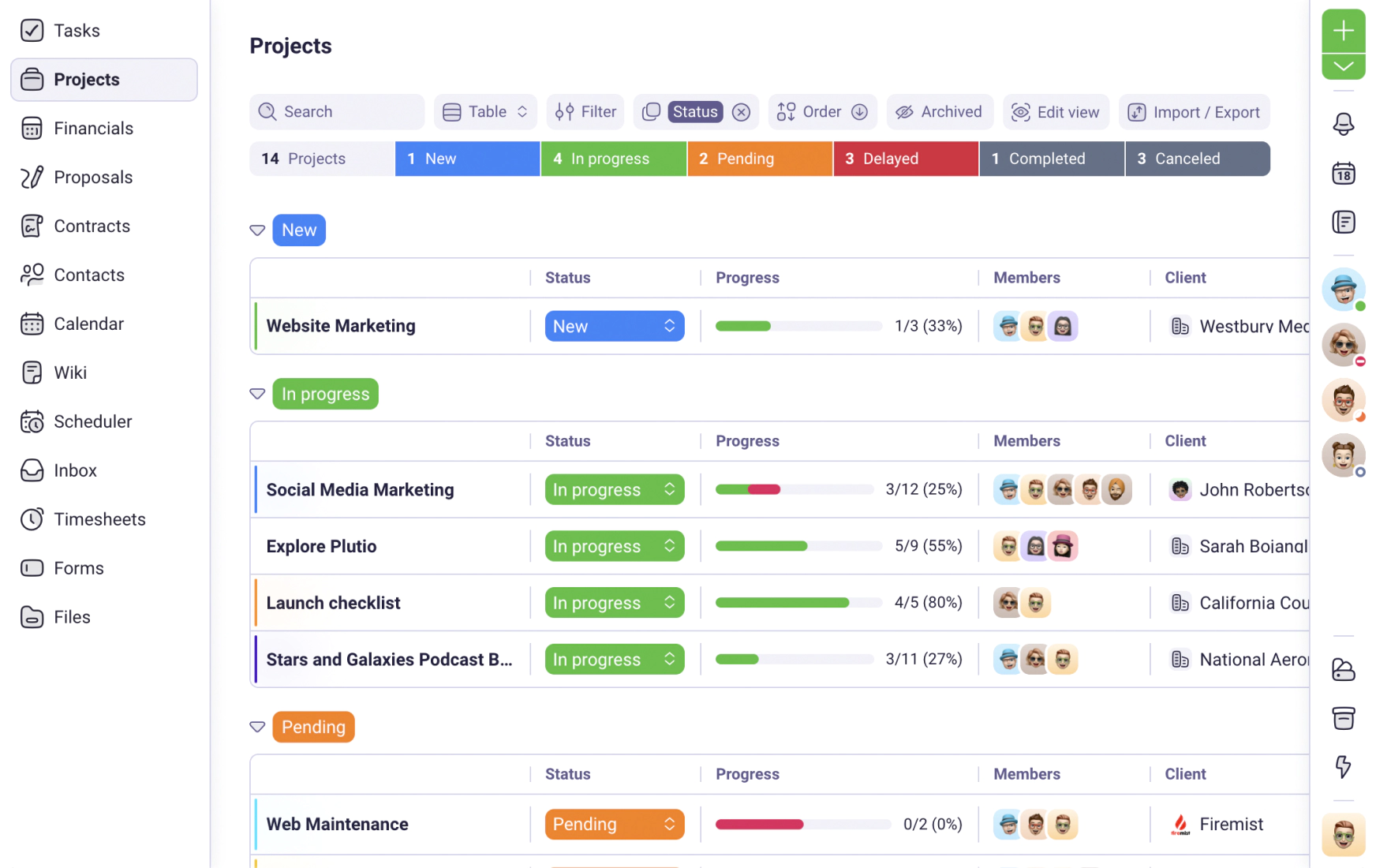

Streamline your processes with Plutio

Although you may have to take action to remind customers or recover your debts, you can avoid problems building up by taking a streamlined approach to invoicing, monitoring and collection.

With a system like Plutio, you can automate many of the important stages:

- Sending and tracking invoices so you know when payment is due

- Creating payment schedules to help manage cash flow

- Applying discounts agreed with individual customers

- Applying appropriate taxes to the invoice

- Sending reminders before and after payment due dates

- Receiving notifications when payment is received

With invoicing and collection under control, you can manage cash flow more effectively and ensure that your business remains viable.

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required