We use cookies to personalise and enhance your experience.

Learn How To Manage Your Finances In 6 Steps

May 6, 2022

While money may not be able to buy you any happiness, it can provide you with financial security. And as the ongoing pandemic has shown, it’s now more important than ever to take back control over your finances. So to help create some peace of mind, below are some simple tips for money management that can help you become more financially secure.

1. Track your expenses

Better management of money starts with having better spending awareness. Your day-to-day spending can get out of control very easily if you’re not monitoring it. So before you can start to save money properly, you need to have an accurate understanding of your expenses. Keep a spreadsheet or use an app to categorise your expenses, and cross-check everything on your bank statements and credit card bills to ensure it’s always accurate.

By tracking your monthly expenses, not only will you be able to see exactly where every dollar is going, but it may also help motivate you to adjust some of your spending habits.

2. Record your income

This might seem pretty obvious, but once you understand your expenses, it’s important to know exactly how much you earn. To determine your net monthly income after taxes, add up how much money you receive from your salary and revenue sources like bonuses, reimbursements, and any other benefits.

Once you have a total figure for your average monthly income, compare it with the total of your average monthly expenses. What if you don’t have much income left over? Or even worse, if there’s not enough to cover all your living expenses? Well, you either need to reduce your expenses or increase your income. Consider finding a side hustle or negotiating for a raise in your salary.

3. Create a realistic budget

Without a strategy, it’s very easy to find yourself coming up short on cash. Now that you have figures for both your monthly income and expenditures, you can start organising them into a realistically workable and comprehensive budget.

Don’t forget to factor in any irregular expenses like home repairs or car maintenance. Your financial plan should outline how to save money while limiting overspending. But you also need to set a realistically achievable budget based on your spending habits. Otherwise, if your budget is too restrictive with drastic lifestyle changes, you’ll be less likely to stick to it despite your good intentions as it’s too suffocating.

4. Set savings goals

Make sure your budget includes a category for savings, which should be around 10% to 15% of your total income. One of the most effective ways to help you save money is by setting goals. This will encourage you to make smarter money choices such as having takeaway coffees less and cooking dinner at home more.

Start by setting smaller and more achievable short-term goals, like a night out or a new tech item. Then work out how much you can afford to save each week and how long it will take to save for it. Not only will you get to enjoy whatever you save for, but reaching smaller financial goals provides a more immediate payoff with enough of a psychological boost that helps reinforce the savings habit.

5. Save for emergencies

After living through recently uncertain economic times, we all know more than ever how important it is to have money on hand for an emergency. Unforeseen circumstances can strike seemingly out of the blue, from unexpected damage not covered by insurance to preparing for divorce.

A financial crisis doesn’t need to be caused by a pandemic to be a major risk. Ideally, you should build up an emergency fund that covers your living expenses for six months, just in case, the worst and unthinkable happens. Not only will having some emergency money saved upkeep you out of financial trouble on a rainy day, but you’ll sleep better in the meantime.

6. Pay off your debt

Prioritize essential spending and avoid late fees by always paying your bills on time. Not only is this a wise way of managing your money, but a strong history of on-time payments also comes with the benefits of an improved credit score and reduced interest rates.

To help get yourself debt-free as fast as possible, look at taking a more strategic approach to repay outstanding debts. Make sure you can at least pay all your minimum monthly payments, and any extra money left over after bills and savings should be used to pay down debt with the highest interest first.

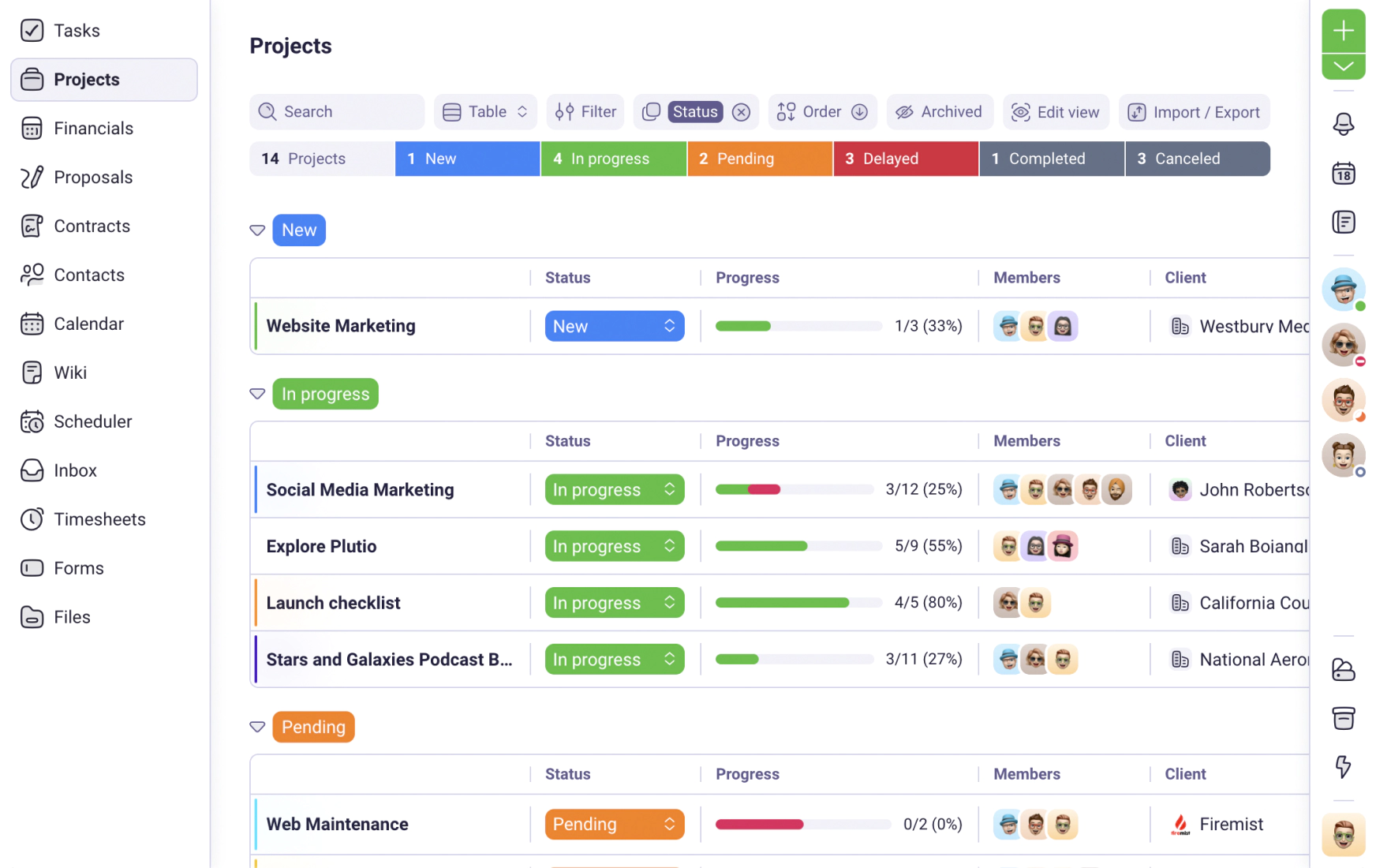

Have you tried Plutio yet?

One app to run, grow, and automate your business with Super Work AI

Try Plutio for FREEStart free today

Your entire business, one login away

No credit card required. No contracts. Just the tools you need to run, grow, and automate your business with Super Work AI.

No credit card required