We use cookies to personalise and enhance your experience.

Agency businesses typically operate on wafer-thin margins. Overheads are an important reason for this.

As an agency, you typically operate from a swanky office in the CBD that is closer to your target market. Agencies are also highly sales-driven - this introduces outreach costs, commuting costs, and also churn costs (sales are high attrition functions) that all add to your ongoing expenses.

However, the post-pandemic world will be completely different to what it used to be. This is a lifeline thrown to agencies that are desperately trying to survive in the slow economy. Cutting down on overheads - which can amount to as much as 30% of your revenues - is an inevitable first step.

Here is how you do it.

Audit your overhead expenses

The first step in the process is to audit your overheads. Where exactly does your money go each month? It helps if you can dig in deeper and prepare an exhaustive list. This could look something like this.

It is a good idea to prepare an audit report as above for the previous 3-6 months. This will give you a good idea of what are your ongoing costs and which of this is simply a one-time expense.

Identify ways to bring these expenses down

Once you have audited your expenses, you can now figure out ways to bring these expenses down. For example, are you still paying office rent? This can be easily eliminated given that all of us have been working remotely the past few months.

Now, even if you do not want to go fully remote in the post-Covid world, there are still strong reasons to consider alternatives. For one, you no longer need a swanky office in the CBD if all your clients are now working remotely.

If your clients don’t work out of an office in the CBD, it also means that you could migrate en-masse to a suburb with lower rental expenses. You could also consider switching to a coworking space if only a few of your workers want to continue in an office setup.

The other major overhead in any organization is employee salaries. Now, you do not fire people just to save costs. Besides, the only way to grow an organization is by hiring more workers.

While laying people off is not the answer, you could however eliminate low-value work so that the average contribution per employee increases significantly.

You could do this by either outsourcing low-value work or investing in software tools that can do the job for a fraction of the cost.

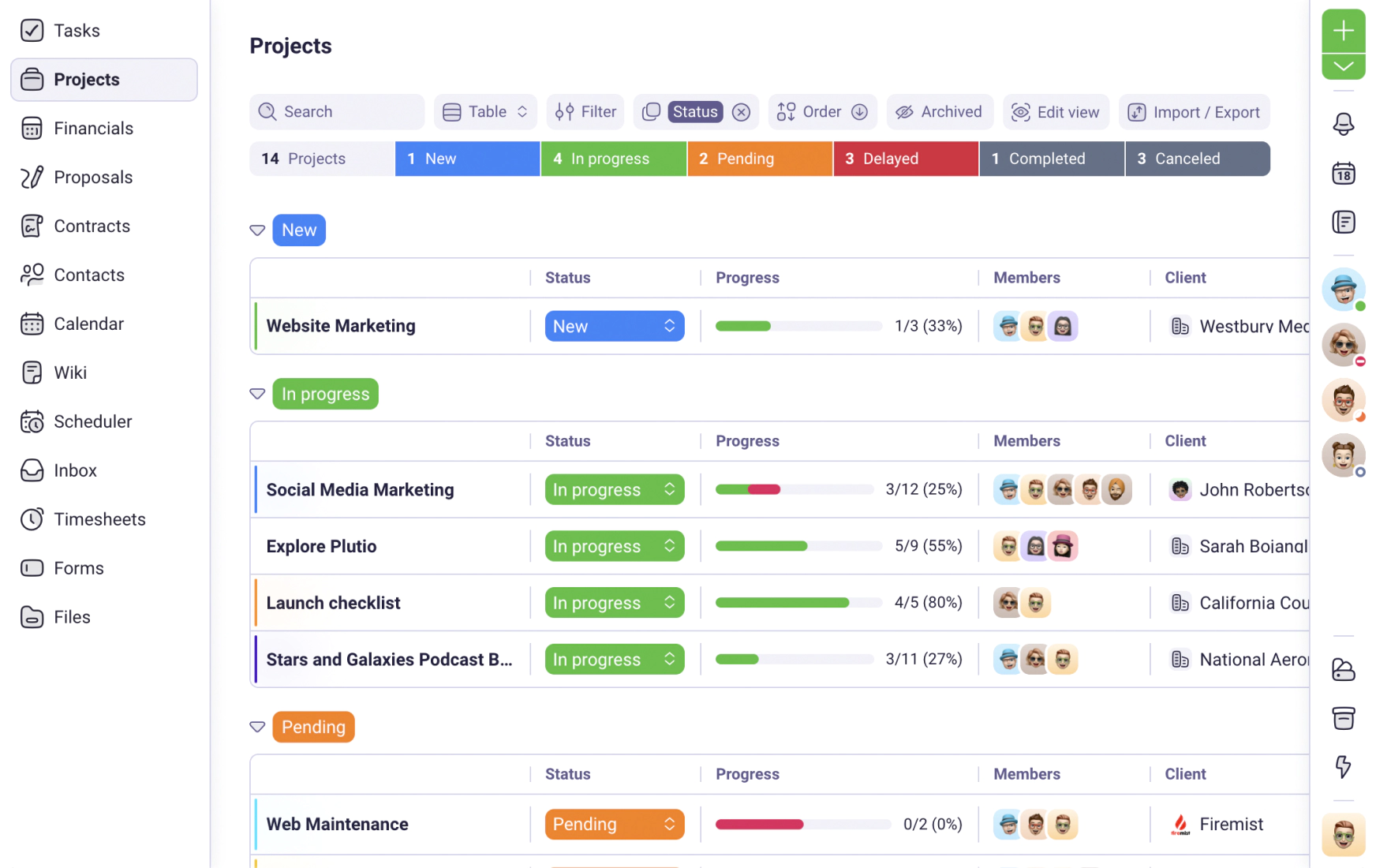

Do you spend money on multiple SaaS products for project management, time tracking, invoicing, contract management, etc.? How about using an application like Plutio that can offer all these various services for way less?

For example, do you have a bloated customer support team that gets the same questions dozens of times each month? You could perhaps invest in a knowledge base that can organize this information for handy reference.

Do you spend hundreds of non-billable hours building demo web pages for various prospective clients? How about using a website builder that can help you meet your objectives faster and thus free up your bandwidth?

Another way to minimize overheads is through automation - by building a system that can programmatically execute tasks that can take hundreds of man hours, you free up your worker bandwidth that can be used for more value-adding tasks.

For example, does your sales team spend several hours manually searching LinkedIn for the right leads? You can build a system that can make use of contact discovery APIs to find the email and phone numbers of the people you want to target. This can save hundreds of hours each month.

The idea here is to increase worker productivity that directly impacts the top line while adopting strategies that can improve the bottom line as well.

Rework salaries

If you are switching to a remote setup, then there are a number of things you can do differently for the future.

- You could hire workers from across the world - and this can bring down salaries further

- Your sales team no longer needs to reimbursed for their travel

- You can completely do away with office space letting people work out of home.

However, this also introduces new components

- The tax structure for your workers change depending on where they reside

- Your employees will now need to be paid extra to set up their home office

A one-time allowance for workers to set up their home workstation is a great idea. However, this can be considered income and be taxed. Consider giving your employees a budget to set their home office and reimburse for their expenses.

Also, you may also consider changing your employee status to contractor. However, this can terribly affect the perks that an employee enjoys. Talk to a professional consultant to figure out a way to ensure that your employees continue to enjoy their perks while giving you flexibility from a tax-perspective.

In conclusion

The Covid-19 pandemic has thrown a spanner in the works for all businesses. Agencies are no exception. However, this is also an opportunity for agency businesses to rework their traditional high overheads and figure out alternatives that are good for their survival as well as workers in the long-term.

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required