We use cookies to personalise and enhance your experience.

Working as a freelancer is a wonderful way to create your dream job and work in the environment that best suits you, but there are also some drawbacks that need to be considered. One of the biggest potential problems when working as a freelancer is your limited rights.

Traditional workforces are protected by various protections and rights granted by state and federal governments, but these things do not typically cover freelancers.

This means that you, as an individual, need to keep in mind potential legal issues that you might come across when freelancing. If you don’t put some energy into protecting yourself while freelancing, such as taking out insurance, you could end up in a situation that is draining mentally and financially. In the future, we’ll likely see more laws enacted to protect freelancers, but that isn’t yet the norm.

Today, learn more about how to protect yourself while pursuing a career as a freelancer. By making sure that you know the answers to these questions, you’ll be better prepared for issues that could crop up at any time.

Do You Understand What Taxes You Need To Pay?

One issue that many freelancers have, especially at the beginning of their careers, is not knowing how to file their taxes correctly. Taxation is a complicated topic across the board, and it gets even more complex when managing your own contracts, payments, and bills without any sort of corporate oversight

Are you aware of what taxes you are responsible for on the local, state, and federal levels

Freelancers are responsible for self-employment taxes. Employees of companies split Social Security taxes and Medicare payroll taxes with their employers, but self-employed individuals must pay these fees in their entirety

Additionally, most freelancers will have to pay taxes quarterly rather than simply doing their taxes once a year. These estimated payments are calculated based on what you expect to make throughout the year, and it can be a complex process to figure out what to pay, so it’s worth investing in accounting software to keep an eye on your accounts and cash flow

Working with a good account is one way to handle your taxes, but you can also invest time learning about them if you want to handle things more directly. A reasonable estimate when receiving payments is to hold roughly 30% of what you make to cover future tax obligations.

Do You Have A Solid Contract In Place

Every freelancer has been in a situation where a client refuses to pay their bill or try to pay something different from what was initially agreed upon. If you don’t have a formal contract in place, there isn’t much to be done about this.

Make sure that you set up contracts with your clients and that your contracts include all critical information:

- Payment terms and obligations

- What services are included

- Any follow-up services that will be provided

- Idea ownership

- Deadlines

- Applicable copyrights

- Termination clause

- Confidentiality clause

Spelling out any details that may be an issue down the line is essential. Even if it might seem like overkill initially, it’s important to use your contracts to protect yourself from losing out on money or getting into legal trouble.

Do You Have Any Conflicting Contracts?

If you work within a specific industry or move from a full-time job to freelancing in an industry, make sure that you don’t have any conflicting no-compete clauses. Sometimes, companies will have employees sign this type of clause so that you cannot compete against them for a set period after leaving that job.

Anytime you sign this type of contract, you may be limiting what future work you can do. Before you start freelancing, make sure that you don’t have any agreements in place that could lead to legal issues. If you aren’t sure, contact a lawyer for further assistance.

Do You Have Your Business Registered Properly?

As a freelancer, you are legally allowed to operate as a sole proprietor. However, in some cases, it might be beneficial to set up a limited liability corporation (LLC) to protect your personal assets from any legal issues.

Not all freelancers feel that this type of protection is necessary, but that is something that you should consider when you are freelancing your career. Ultimately, these are not required steps, but it is a good idea to be aware of your options and their implications.

Do You Have Necessary Business Licenses and Insurance?

Finally, find out if you need to have a business license to operate your freelancing business. Not all freelancers need to take on business licensing or insurance, but some do. The answer to this question is largely dependent on your local laws and what industry you are working in.

Final thoughts

If you need any licenses or permits, make sure that you have followed the proper procedure to obtain these things before you begin working. Operating as a freelancer without the appropriate licensing could lead to big legal issues, so this is something that you definitely want to avoid.

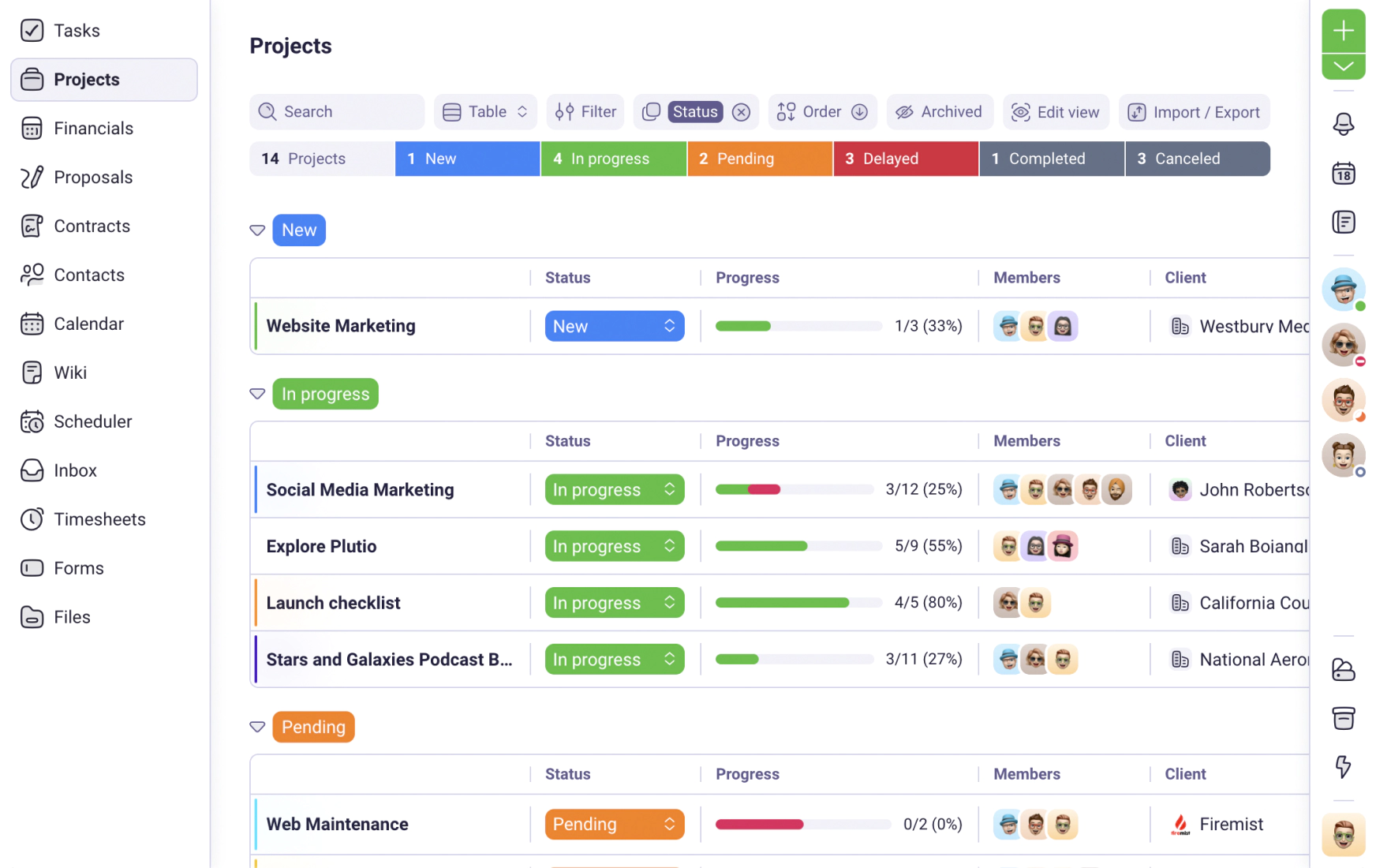

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required