We use cookies to personalise and enhance your experience.

Choosing to become a freelancer nowadays is not an easy decision. There are numerous aspects to consider, as well as many upsides. This type of employment comes with more than one quality aspect. You can choose to work on a few projects simultaneously or stay on one big project working for the same client for a long period of time. On the other hand, you may be able to set your working hours as you please.

Being able to plan your schedule and work from home is one of the best benefits that a freelancer can boast about. As this job becomes more and more popular and frequent around the world, there are numerous laws that address the specific terms and security points that will protect every person involved in this process. One of the aspects that are quite important for most freelancers is social security. That is why we today have more than one app for freelancers that may help you organize better and keep up with your tasks and finances. Take a look at some of the social security tips you should know about if starting your career as a freelancer.

Are freelancers required to pay taxes?

As a freelancer, you are not in the position to forget about social security and medical care. As well as employees that work in various companies and receive salaries on a regular basis, freelance workers also have that possibility. Freelancers are eligible for social security, but paying taxes is also a part of the job. It is not the same amount as salaried employees pay, or their companies pay for them. However, it is certainly easier when you are your own boss.

You pay self-employment taxes on your earnings when you are a freelancer. Those taxes cover your medical care as well as social security. These possibilities are quite valuable when it comes to your safety and your retirement, disability, etc. If you use any of the popular apps for freelancers, you will get around your paperwork with ease. Specific apps that most freelancers use are the quality source of information regarding every aspect of your work, including the social security paperwork.

Social security for freelancers – what does that really mean?

As we all know, every working individual must report their earnings for Social Security. This process is quite simple - if you own a business, or you are a freelancer, you are a self-employed individual. Like everyone else, you should file your income tax return this coming tax season. This process is quoted differently when you are an employee of a company versus when you work as a freelancer. In most cases, an employer deducts specific amounts of your salary and pays for your Social Security and Medicare tax. However, as a freelancer, you employ yourself, and you file for taxes.

In a situation when you pay your own taxes as a freelancer, you will have to pay a specific amount depending on your earnings. The ballpark figure is carefully calculated as a percentage of what you earn. In case you and your partner share a business, and you are married, you will both file your taxes and pay a little bit more.

In case you earn more than 400 dollars a year, you must report your earnings to the IRS. Most individuals complete this task by filling out Form 1040. If you are self-employed, you should file an annual tax return and quarterly estimated tax payments. If you are just becoming a freelancer, make sure to consult a professional that specializes in taxes before you fill out all the paperwork coming tax season. For filing taxes on your own, you can always rely on some apps for freelancers to help you calculate your expenses. This way, you will be safe when it comes to changing your status and filling the right kind of paperwork.

What are the benefits of social security for freelancers?

The Social Security Administration in short will determine a worker’s benefits depending on their income. The same system will determine the type of benefits for freelancers the same way it will for the workers employed by other companies. There are numerous benefits that you may expect if you pay your taxes every year. Here are just some of the most important benefits you are eligible for when working as a freelancer.

- Retirement – If you are born after the year 1929 you may need to earn 40 credits to be eligible for retirement benefits. This means that you earn your points while working during the period of 10 years. After that period the benefits you will receive will depend on multiple factors like your age, the number of points you collect while working, etc.

- Disability and survivor benefits- in case of any injury that leads to disability of some kind, a person is protected if they pay taxes. However, even this quote is carefully calculated and evaluated. In bulk, workers that suffered a change and how they are disabled also worked before the disability. The quote is calculated depending on their age and the time period they previously worked. That is called disability benefit. In case of divorce, the death of a spouse, you may claim your deceased relative social security benefits. People eligible for this type of benefit have difficult circumstances and provide specific documentation to apply for this benefit.

Running a business as a freelancer

As a freelancer, you are essentially a business owner. In this case, you need to handle your business plan and keep an infrastructure of some kind to help you navigate your workload as well as the business part of the equation –paperwork.

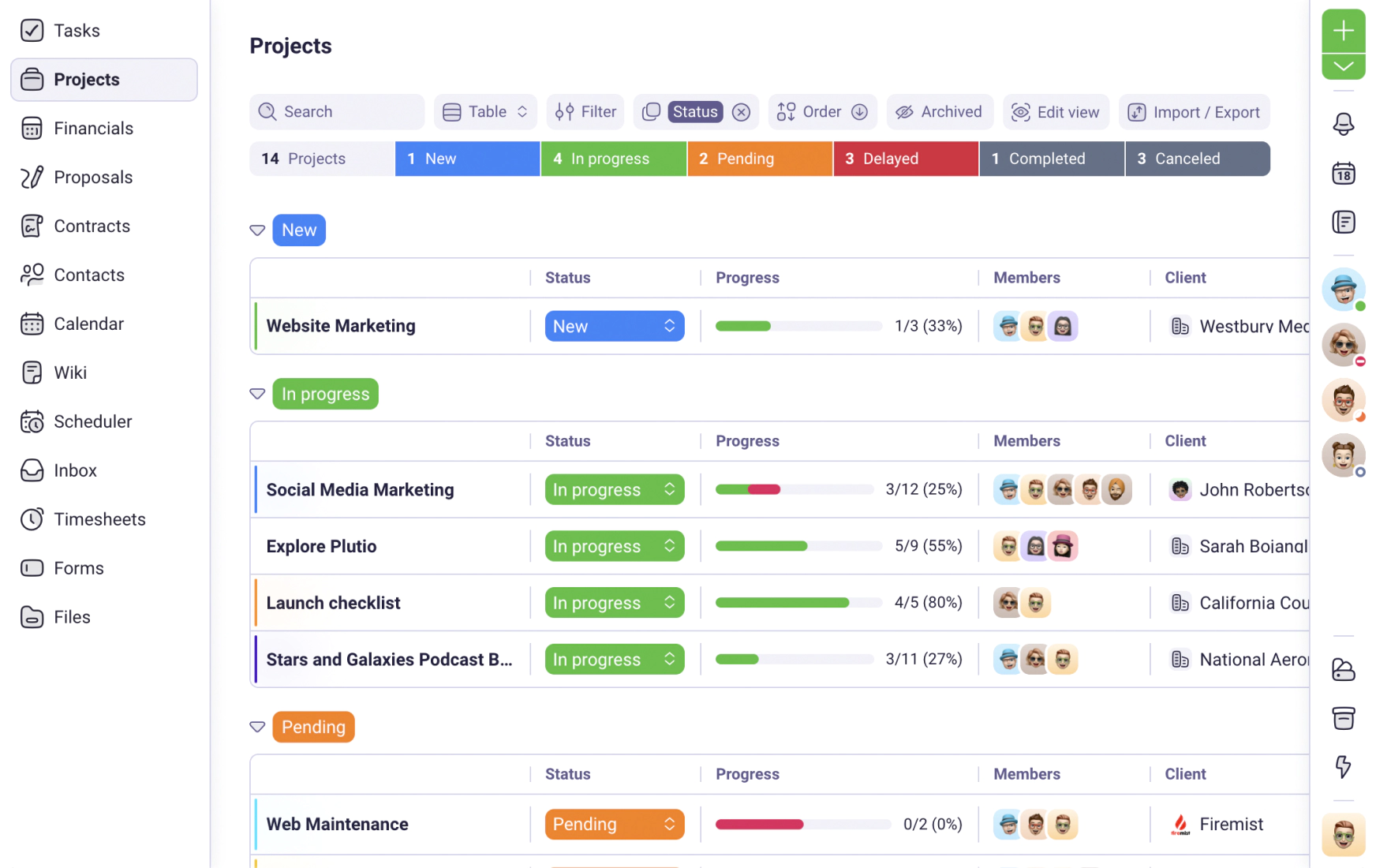

It is easy to keep track of your assignments, invoices, client lists, payments, and other important paperwork using an app for freelancers. If you consider giving an app for freelancers a try, you may be able to get more work done and have everything important regarding your business in one place. Also, all the important data will be at your fingertips and at the same place at all times.

Keep in mind that apps for freelancers are numerous. Most of them concentrate on different tasks. Depending on the type of your business, you should choose the app that best suits your specific needs.

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required