We use cookies to personalise and enhance your experience.

Blog/Freelancing

Starting Your Freelance Business: Financing Options Available to Freelance Businesses

August 28, 2021

The pandemic has fueled the ever-growing gig economy. Many individuals have become solopreneurs, whether out of want or need. With freelance businesses becoming even more commonplace, self-employed entrepreneurs realize the importance of standing out from the competition.

Building a reputable company not only requires skill, but it also means having a marketing budget and the right tools to do the best job you can. That all requires capital, though.

What options do you have when you find yourself in need of financing to fund business expenses? Here are a few options to consider.

5 Best Freelance Business Funding Solutions

While you could always apply for a personal loan or grant money, you do have other choices to consider. Whether you’re a graphic designer, writer, business consultant or other type of freelancer, here are a few of the best business loans and alternative financing options available.

Line of Credit

A line of credit is the most flexible type of financing, and it’s there when you need it. Think of it in a similar way that you’d view a credit card. You get approved for a certain credit limit, and you can draw funds from that credit line as needed.

Pay interest only on the amount you borrow. Additionally, your credit line is typically restored up to the original limit as you pay down your outstanding balance.

Of course, business credit cards (or personal credit cards) are another option when you’re in search of a way to finance your freelance business.

Microloans

If your funding needs are minimal or you’re just starting as a freelancer, a microloan may be a good option. These loans are usually made by nonprofit lenders. They can be taken out for just a few thousand dollars, though up to $50,000 may be available, such as through the Small Business Administration’s Microloan program.

Business Term Loan

If you have a large project you want to fund, a business term loan can be another option. They are available through banks and alternative lenders. With this type of loan, you’re approved for a lump sum of money, which you usually repay monthly or weekly over a fixed period. Short-term loans may be paid back in just a few months, while repayment for long-term loans could span years.

Invoice Financing

Invoice financing, also known as accounts receivable financing, is a type of fast, short-term funding. With this type of financing, you’re able to access money already owed to you because you use your invoices as collateral.

Lenders look at the quality of invoices when determining whether to approve you. If approved, you receive an advance of the invoice value — usually in the range of 70-80%.

You make installment payments over the course of your financing term until your balance, plus interest and fees, is paid in full.

Merchant Cash Advance

A merchant cash advance is one of the most accessible forms of financing and allows you to access funds based on your business’s future sales. It can be an option for freelancers who need money fast and don’t have the best credit score.

This type of financing is often categorized by high-interest rates, short terms and more frequent payment installments than other types of financing, sometimes requiring daily or weekly payments.

Why Freelancers Apply for Business Loans

Once you’re in business for yourself, needs arise, sometimes when you least expect them. Here are a few reasons you might seek short- or long-term financing.

Market Your Business

Costs to market your business can add up. Depending on your niche, you may spend money on social media advertising, search engine advertising, print ads and more. Creating a website and maintaining it also has its fair share of expenses. Whatever the case, an extra bit of capital can help you cover the costs to build your brand.

Buy Equipment

Do you need a business vehicle, a new computer or other hardware? When the costs to get the equipment you need to operate are slightly out of reach, consider what type of financing can get you the machinery you need to keep business running smoothly.

Cover Operating Expenses

Most freelancers have experienced ebbs and flows in business. Some months you may have more projects than you feel you can handle, while other months might be slow going. When business is down, you may not have the funds you need to cover everyday business expenses. Interim financing can help bridge gaps in income.

Where to Find Funding for Your Freelance Business

Aside from seeking funds from family and friends or starting a crowdfunding campaign, where can you turn for capital to help your freelance business take off?

Banks, credit unions, online alternative lenders and investors are all options.

However, as a freelancer, it can be challenging to qualify for a business loan. This is particularly true with conventional lenders, such as banks and credit unions, who may view your sole proprietorship as risky.

Keep in mind, in addition to considering your business and industry, lenders will look at your credit score, time in operation and revenue when evaluating you for approval.

While alternative lenders’ qualification requirements are typically less challenging to meet, rates and terms are usually less competitive too.

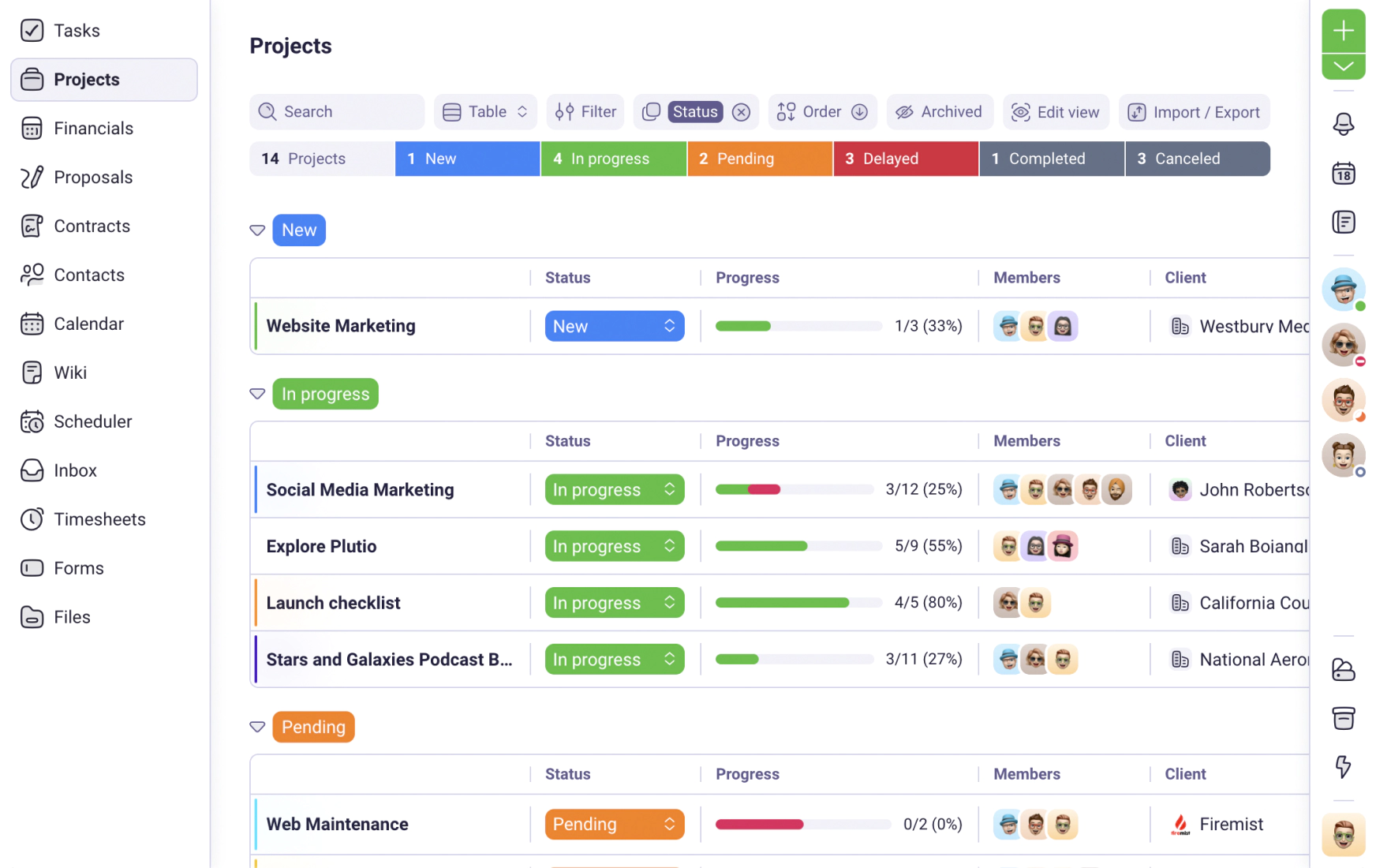

Have you tried Plutio yet?

The only app you need to run your business and get work done.

Try Plutio for FREESupercharge your business

The complete toolkit to run your business

The intuitive all-in-one solution to manage and collaborate on projects, share files, build forms, create proposals, get paid, and automate your workflow.

No credit card required